Beauty Industry

Coty Faces Sales Setback but Vows Beauty Rebound Despite Global Pressures

With a 3% decline in Q3 revenue, Coty trims its annual forecast as inflation, tariffs, and cautious consumers weigh on growth

Global beauty powerhouse Coty Inc. has reported a 3% dip in sales for its fiscal third quarter, prompting the company to revise its annual forecast amid what CEO Sue Nabi describes as a confluence of economic headwinds. While the company remains optimistic about future performance, its Q3 results underscore the challenges many consumer goods giants are facing in 2025.

According to Coty’s quarterly earnings report, net revenue fell by 3% year-over-year, a drop driven by soft demand across several key categories. Nabi attributed the dip in momentum to rising global tariffs, inflationary pressure, and recessionary fears affecting consumer confidence, particularly in Europe and Asia.

“We are navigating a complex macroeconomic environment,” said the Coty CEO during the company’s earnings call. “While our core beauty brands remain resilient, external pressures have undoubtedly softened demand and impacted discretionary spending.”

The company, which owns iconic brands such as CoverGirl, Rimmel, and fragrance lines under Burberry and Gucci, had previously projected stronger growth through 2025. However, the updated guidance reflects a more cautious outlook, with Coty adjusting its full-year earnings growth target to the lower end of its original forecast range.

Despite the setback, executives at Coty remain bullish about long-term prospects. Nabi emphasized Coty’s continued investment in innovation and premiumization—especially in skincare and fragrance—as essential strategies to weather economic turbulence and reignite sales.

Interestingly, Coty’s prestige division, including high-end fragrances and skincare, showed signs of relative strength, cushioning the broader decline. The company is also reportedly accelerating digital transformation efforts and direct-to-consumer sales channels to counteract retail volatility.

Industry insiders speculate that while Coty’s current headwinds reflect broader beauty market fluctuations, the brand’s strategic pivots could prove advantageous in the coming quarters. According to market analysts, the demand for affordable luxury and skincare solutions could surge again as consumers seek small indulgences during economic uncertainty.

“In beauty, perception is everything. As long as Coty continues to innovate while managing costs and scaling smartly, a rebound isn’t out of reach,” said one analyst familiar with Coty’s international operations.

As the global beauty market recalibrates, Coty’s ability to adapt under pressure may determine its competitive edge in an increasingly crowded field. With Sue Nabi at the helm and consumer behavior evolving rapidly, all eyes are on how the cosmetics giant will balance ambition with caution.

-

World News4 days ago

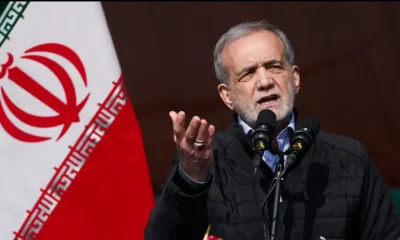

World News4 days ago1-Iran Issues Dire Warning to Israel and Defies Trump on Nukes: “We’re Ready to Strike Deep Inside”

-

Weather3 days ago

Weather3 days agoGilbert Weather Forecast Turns Volatile Heat Advisory and Storm Watch Issued

-

Sports7 days ago

Sports7 days agoRicky Ponting once said “I learned from the best” but who were Australia’s 5 greatest cricketers ever?

-

Entertainment4 days ago

Entertainment4 days agoOzzy Osbourne dies at 76 after final concert with Black Sabbath fans say It finally caught up with him…

-

Cricket1 week ago

Cricket1 week agoTop 5 Fastest Bowlers in Cricket History Who Delivered Blazing Thunderbolts that Shocked the World

-

Entertainment1 week ago

Entertainment1 week agoColdplay CEO Scandal Shocks Tech World as Viral Jumbotron Clip Forces Astronomer Chief on Leave and Sparks 7 Unbelievable Reactions

-

Sports1 week ago

Sports1 week agoAndre Russell Drops Bombshell Hint at Retirement from International Cricket — What’s Next for the T20 Fearless Titan?

-

Entertainment4 days ago

Entertainment4 days ago7 Powerful Lines from Jessica Simpson’s Fade Song That Reveal the Truth Behind Her Breakup