Tech

Michael Saylor Buys Another $531M in Bitcoin as Strategy Holdings Soar Above $42 Billion

With Bitcoin back over $107K Strategy adds nearly 5000 more coins pushing its total to 597325 BTC and edging closer to a 25 percent yield goal

Michael Saylor and his firm Strategy are back at it—snapping up another $531 million worth of Bitcoin last week as the world’s most valuable cryptocurrency surged past $107,000.

According to a new SEC filing published Monday, Strategy acquired 4,980 BTC between June 23 and June 30, at an average price of $106,801 per coin. This latest haul pushes the company’s total Bitcoin holdings to a staggering 597,325 BTC, acquired for about $42.4 billion at an average of $70,982 per coin.

That makes Strategy the largest corporate holder of Bitcoin on the planet—and it’s not slowing down.

“I’m buying it for the dude that’s going to work for the dude that’s going to get hired by the guy who takes over my job in 100 years,” Saylor once said in a 2020 interview with RealVision’s Raoul Pal, which he reposted on X this week.

With this latest purchase, Strategy’s year-to-date BTC gain now totals 85,871 coins, valued at $9.5 billion, moving steadily toward its 2025 yield target of 25%. The company’s BTC yield rose to 19.7% YTD, and its quarter-to-date yield edged up to 7.8%.

Strategy Moves Nearly $800M in BTC to New Wallets

According to blockchain analytics platform Lookonchain, Strategy also transferred 7,383 BTC (worth approximately $796 million) to three newly created wallets last Sunday. Analysts suggest the move is likely tied to improved custody or strategic asset management.

“Aside from one small sellback in 2022, they’ve been strictly buy-and-hold,” Lookonchain noted.

The only sale Strategy has made so far was in December 2022, when it briefly sold 704 BTC for $11.8 million and repurchased 810 BTC two days later for $13.6 million.

Betting Everything on Bitcoin

Saylor has long been known for his conviction. Since Strategy’s first BTC purchase in August 2020, he has doubled down repeatedly, turning the firm into a proxy for institutional Bitcoin exposure.

In his reposted 2020 interview, he described Bitcoin as “economic immortality”, making it clear he sees the asset not as a trade—but a mission.

“When it goes up by a factor of 100, I might borrow against it. But what am I going to buy with it that’s better than what I’m buying?”

With Bitcoin trading above $108,000 as of this writing, Saylor’s conviction appears to be paying off. Strategy’s average entry price of around $71K now positions it to reap enormous unrealized gains—assuming it holds, as it always has.

In the volatile world of crypto, Michael Saylor isn’t just holding the line—he’s drawing a new one in digital stone.

Tech

Ripple CTO Confession About Censoring Ozzy Osbourne Sparks Emotional Internet Storm

Ripple CTO David Schwartz admits he faked fan questions and censored Ozzy Osbourne during a Q&A session and now calls it one of his biggest regrets

In a heartfelt and unexpected confession, David Schwartz, the Chief Technology Officer of Ripple, has admitted that he once censored Ozzy Osbourne and faked questions during what was intended to be a real-time Q&A session with fans of Black Sabbath. The revelation came via a post on X (formerly Twitter), just days after the legendary rock icon Ozzy Osbourne passed away at the age of 76.

The Ripple CTO shared that the incident occurred during his tenure at WebMaster, a company where he was tasked with facilitating a fan conference using the firm’s ConferenceRoom software. His role? To listen to band members over the phone and type their responses live as fan questions were asked — except that’s not what really happened.

I cheated,” Schwartz confessed. “To me personally, it was a failure, but to everyone else it was a success.

Fans Only Wanted Ozzy

According to Schwartz, it became obvious very quickly that fans only cared about Ozzy. “Every question was for Ozzy,” he said, noting that he even asked moderators to steer questions to other band members — but there simply weren’t any.

To avoid leaving the rest of the band out, Schwartz said he began using a list of pre-written canned questions. These questions had been prepared in case of technical glitches but ultimately served as filler to make it appear that the other band members were getting engagement.

I passed a canned question to each of the other band members in rotation. And I mixed what I could make out of what they said with the canned answer from their manager.

The Ripple CTO said that while the event appeared to go smoothly to the audience, internally he felt it was a complete failure — primarily because it lacked the authenticity and fan engagement that had been promised.

Cleaning Up Ozzy’s Language

The confession didn’t end there. Schwartz went on to reveal that Ozzy Osbourne’s responses were heavily laced with profanity, particularly the C-word — and not the mild kind.

Ozzy’s answer featured the C-word a lot. The bad C-word. The one that Americans really don’t like to say. It was pretty close to the only word I could hear clearly.

Given the poor call quality and the explicit content, Schwartz admitted to censoring Ozzy’s language as he typed out the responses, which meant fans weren’t hearing the raw, unfiltered Ozzy that they likely expected.

A Moment of Regret and Reflection

Now, in the wake of Ozzy Osbourne’s passing, Schwartz says he regrets the inauthentic exchange more than ever. What was meant to be an opportunity for fans to connect with a musical legend was instead a scripted, sanitized interaction.

It wasn’t the authentic interaction with celebrities that I wanted it to be and that I tried to make it,” he wrote. Only “two or three” legitimate questions ever made it to the band.

This bittersweet confession adds an emotional layer to the outpouring of tributes for Ozzy, who was a cultural icon in both music and pop culture. Known for his wild personality, dark humor, and groundbreaking contributions to heavy metal, Osbourne’s legacy continues to resonate across generations.

Memecoins and Market Reactions

Interestingly, Ozzy’s death also had an impact on the crypto space. A memecoin titled The Mad Man (OZZY) surged over 16,800%, reaching a price of $0.003851 and pushing its market cap to $3.85 million, according to a report by Cointelegraph.

It’s unclear if Schwartz’s confession will impact Ripple’s brand perception, but his honesty has certainly sparked discussions around authenticity in digital interactions and celebrity engagement.

In the end, the Ripple CTO’s admission isn’t just about an old chatroom mishap. It’s about the desire to do right by artists and fans — and a reminder that, even in tech-driven spaces, authenticity matters.

Crypto

16 Day Surge Spot Ether ETFs Add 453 Million in Inflows and Investors Say This Is Just the Beginning

Spot Ether ETFs continue their explosive streak with $453 million in inflows led by BlackRock as bullish momentum shows no signs of slowing

In an unprecedented run that has crypto bulls cheering, spot Ether ETFs have now notched their 16th consecutive day of net inflows, with Friday alone contributing a staggering $452.72 million, according to fresh data from SoSoValue. The bulk of that came from BlackRock’s iShares Ethereum Trust (ETHA), which alone pulled in $440.10 million, pushing its total assets under management to an industry-leading $10.69 billion.

The cumulative momentum of spot Ether ETFs has propelled total net assets across all U.S.-based funds to $20.66 billion, now representing 4.64% of Ethereum’s total market cap. With cumulative net inflows reaching $9.33 billion since their launch, Ether ETF adoption is clearly gathering pace—particularly among institutional investors betting big on Ethereum‘s long-term utility in DeFi, staking, and smart contracts.

With surging interest in stablecoins and tokenization, we expect strong ETH ETP inflows for a long time to come,” noted Matt Hougan, Chief Investment Officer at Bitwise, on X earlier this week.

BlackRock Dominates While Grayscale Lags

While BlackRock continues to dominate the leaderboard in the spot Ether ETF landscape, Bitwise’s ETHW trailed far behind with $9.95 million in inflows. Fidelity’s FETH also added a modest $7.30 million. On the flip side, Grayscale’s ETHE saw continued redemptions, logging a $23.49 million net outflow on the day, bringing its cumulative losses to a staggering $4.29 billion.

This divergence in performance among issuers is becoming increasingly pronounced, as investors flock toward more transparent and lower-fee funds offered by BlackRock and Fidelity, while older legacy products like Grayscale’s ETHE lose their shine.

Institutional Demand Outpacing Supply

What’s driving the surge in spot Ether ETFs? Experts say it’s a mix of improved regulatory clarity, Ethereum’s growing dominance in decentralized finance, and a belief that ETH will play a central role in future tokenized financial systems.

Matt Hougan estimates demand for Ether via ETFs and other exchange-traded products (ETPs) could reach $20 billion in the coming year, equivalent to 5.33 million ETH at current prices. That’s particularly significant when compared with Ethereum’s estimated issuance of just 0.8 million ETH in the same time frame — a mismatch that could lead to a supply squeeze.

We’re looking at a scenario where demand may outpace new ETH issuance by nearly 7X, said Hougan.

Spot Ether ETFs Outshine Bitcoin Counterparts

While spot Bitcoin ETFs also posted a rebound with $130.69 million in net inflows on Friday, they trailed Ether funds significantly. Bitcoin ETFs had seen three consecutive days of outflows earlier in the week totaling over $285 million, suggesting some rotation of investor interest toward Ethereum-based products.

Despite this, the cumulative total for spot Bitcoin ETF inflows remains higher, at $54.82 billion, with total net assets standing at $151.45 billion.

However, recent enthusiasm and performance metrics clearly favor spot Ether ETFs, especially as Ethereum’s broader use case continues to attract forward-thinking institutional players.

Will the 16-Day Streak Continue?

With daily inflows still going strong — including peak days like $726.74 million on July 16 — analysts are watching closely to see just how long this bullish streak in spot Ether ETFs can last. Since the streak began on July 2, total net inflows have more than doubled from $4.25 billion to over $9.33 billion.

And with Ethereum’s upcoming ecosystem upgrades, including developments around Layer 2 scaling, restaking, and more robust institutional-grade staking solutions, there’s reason to believe that investor appetite for spot Ether ETFs is far from satisfied.

Final Thoughts

This historic 16-day streak in spot Ether ETFs not only highlights a turning point in crypto investing but also shows how Ethereum’s evolving role in finance is driving real-world demand. While BlackRock leads the charge, the entire industry appears to be gaining ground in reshaping traditional portfolios.

If this trajectory holds, 2025 might just be the year Ethereum goes fully institutional.

Business

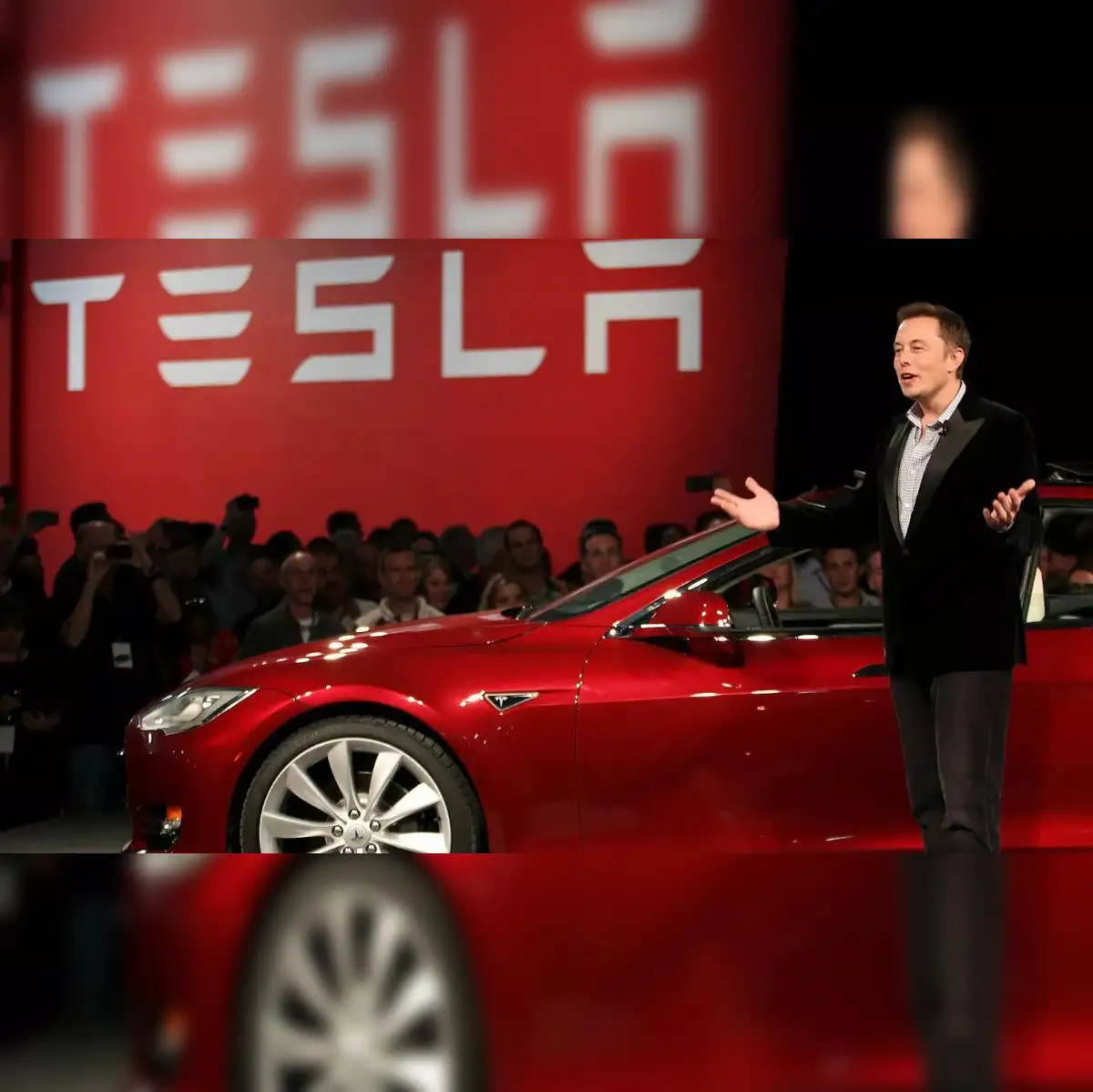

1-Tesla’s Earnings Vanish From the Conversation as Elon Musk Talks Robots and “Someday Soon” Dreams

With profits plunging and sales collapsing, Elon Musk dodges hard questions in Tesla’s earnings call — and Wall Street is finally noticing

On Wednesday night, Tesla released its second-quarter earnings report, and by Thursday morning, its stock was down over 8%. The reason? Crashing car sales, shrinking profits, and looming federal tax credit cuts. But you wouldn’t know any of that if you only tuned into the company’s investor call.

In an hour-long earnings call that barely mentioned the word “earnings,” Elon Musk steered the narrative toward Tesla’s future as an AI and robotics empire, not its present-day struggles as an automaker. Musk painted a grand picture of humanoid robots, robotaxis, and a sci-fi-style future where Tesla isn’t just building cars — it’s revolutionizing technology.

“We’re in a weird transition period,” Musk admitted during a brief moment of candor, referencing the upcoming loss of the $7,500 federal EV tax credit and vanishing regulatory credit sales — both key profit drivers for the company.

But that was it. The rest of the call was a futuristic detour. Analysts asked about Full Self-Driving, the Optimus robot, and other projects that still live more in concept than in consumer garages. Meanwhile, the elephant in the room — Tesla’s collapsing sales and shrinking margins — was quietly ignored.

And Wall Street noticed.

“The company offered remarkably little detail on some of the most important factors,” said William Stein of Truist, expressing concern that the outlook now depends more on imagination than realistic numbers.

Even Dan Ives, a longtime Tesla optimist from Wedbush Securities, expressed disappointment.

“It wasn’t a Hall of Fame call,” he told CNN, admitting that “communication was less than stellar.”

And still, Musk kept talking about the future. A future where Tesla sells millions of Cybertrucks, a future where cars drive coast to coast without human input, and a future where robots handle everyday tasks.

“Someday soon,” Musk implied again and again — without concrete timelines or deliverables.

The irony? Tesla’s stock valuation — still one of the highest in the world — depends heavily on those very promises. That’s what makes investors nervous. As Gordon L. Johnson, one of Tesla’s most vocal critics, put it:

“The key to convincing the market you’re not just a car company is to avoid discussing your car business… If you’re trying to justify a trillion-dollar valuation while your core business stagnates, it helps to keep the details as fuzzy as your timeline.”

And fuzzy, it was.

While sales continue to slide and profit margins shrink for the third consecutive quarter, the conversation has shifted from earnings reports to sci-fi storytelling. But investors are starting to question how long that strategy can hold.

“Tesla has stopped being a car company that talks about technology,” one analyst noted. “It’s now a tech dream that avoids talking about cars.”

This transition might excite futurists, but for shareholders who are watching red numbers on earnings sheets, it raises tough questions:

wall Street’s sharp selloff suggests the market is growing impatient with promises without performance.

For a company that once revolutionized electric vehicles, Tesla now risks being seen as more hype than hardware.

Investors are increasingly demanding transparency and tangible results, not just ambitious tech forecasts.

Even longtime believers are starting to ask: How long can Tesla ride on “someday soon”?

As profits decline and competition from legacy automakers heats up, the pressure is mounting.

Meanwhile, the public still hasn’t seen the affordable Tesla that’s been teased for years.

Without clearer answers, Tesla’s dream of being an AI-first company may be a tough sell on the trading floor.

Investors don’t just want vision — they want viability.

And right now, Tesla’s balance sheet tells a different story than Musk’s microphone.

Until the company bridges the gap between imagination and execution, confidence may continue to erode.

For more Update http://www.dailyglobaldiary.com

-

World News3 days ago

World News3 days ago1-Iran Issues Dire Warning to Israel and Defies Trump on Nukes: “We’re Ready to Strike Deep Inside”

-

Weather3 days ago

Weather3 days agoGilbert Weather Forecast Turns Volatile Heat Advisory and Storm Watch Issued

-

Sports6 days ago

Sports6 days agoRicky Ponting once said “I learned from the best” but who were Australia’s 5 greatest cricketers ever?

-

Entertainment4 days ago

Entertainment4 days agoOzzy Osbourne dies at 76 after final concert with Black Sabbath fans say It finally caught up with him…

-

Cricket1 week ago

Cricket1 week agoTop 5 Fastest Bowlers in Cricket History Who Delivered Blazing Thunderbolts that Shocked the World

-

Entertainment1 week ago

Entertainment1 week agoColdplay CEO Scandal Shocks Tech World as Viral Jumbotron Clip Forces Astronomer Chief on Leave and Sparks 7 Unbelievable Reactions

-

Sports1 week ago

Sports1 week agoAndre Russell Drops Bombshell Hint at Retirement from International Cricket — What’s Next for the T20 Fearless Titan?

-

Entertainment3 days ago

Entertainment3 days ago7 Powerful Lines from Jessica Simpson’s Fade Song That Reveal the Truth Behind Her Breakup