Business & Finance

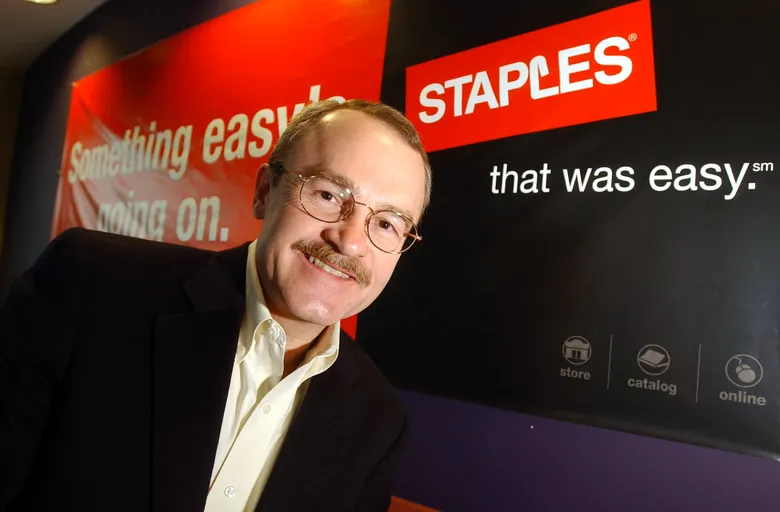

Ron Sargent Worth 2025 — Career, Salary, Biography, and More

From stocking shelves at Kroger to leading the retail giant—discover how much Ron Sargent is worth today and why the spotlight is on him.

Ron Sargent is an American business executive currently serving as the interim CEO and chair of Kroger. As of 2025, his estimated net worth is approximately $92.3 million, built through executive roles, stock holdings, and board memberships. People are searching his name now due to his high-profile takeover of Kroger amid leadership turmoil and hefty compensation package.

Early Life and Background

Ronald L. Sargent was born in 1955 in Fort Thomas, Kentucky. He earned both his BA (1977) and MBA (1979) from Harvard University. Early in his career, he began at Kroger stocking shelves and operating a cash register—humble beginnings for a future executive .

Career Highlights

Sargent joined Staples in 1989, rising to CEO in 2002 and later serving as chairman until early 2017 . Known for steering Staples through rapid expansion and managing regulatory hurdles, he then joined the board of Wells Fargo in 2017 . In March 2025, he returned to Kroger—this time as interim CEO and chairman—after Rodney McMullen resigned following an ethics probe .

Sources of Income

- Base Salary & Stock at Kroger: Annual salary of $4.35 million plus ~60,515 restricted Kroger shares worth ~$4 million .

- Stock Ownership: Holds shares in Staples (

$23M), Five Below ($12M), Kroger (~$8–13M), plus smaller stakes in Home Depot, Wells Fargo, and Mattel - Board Compensation: Income from serving on boards like Wells Fargo and Five Below, and charitable foundations.

Net Worth Growth Over the Years

Sargent’s net worth has grown impressively in recent years.

- 2021: ~$45 million

- May 30, 2025: ~$26 million (per some sources)

- March 31, 2025: $92.3 million (derived from stock holdings)

Assets and Lifestyle

While Sargent keeps a relatively low public profile regarding personal luxuries, his portfolio suggests a high-net-worth lifestyle. With tens of millions in stock holdings, he likely owns upscale real estate and enjoys executive perks typical for someone leading Fortune 500 companies. No specific home or car details are publicly disclosed.

Is Ron Sargent a billionaire?

No—his net worth ranges between $26M and $92M, far below billionaire status.

How does Ron Sargent make his money?

Through executive compensation (salary, bonuses, stock grants) and substantial equity in companies like Staples, Kroger, and Five Below.

What is Ron Sargent’s salary as interim CEO of Kroger?

He earns a base salary of $4.35 million annually, plus approximately $4 million in restricted stock, totaling around $8.3 million .

Local News

Un-certified for the Top Job: 5 Revealing Facts About Why the Town of Watertown’s Fire Chief Was Removed

After nearly a decade leading, David Johnston is out as chief of the Town of Watertown Fire District — and it all boiled down to a piece of paper.

Why Watertown Fire Chief David Johnston Was Removed: Certification Issue Explained

In a move that has stirred strong emotions within the firefighting community of the Town of Watertown (NY), the long-serving chief of the local fire district has been removed from his leadership post — not because of misconduct or negligence, but simply because the paperwork required for the role wasn’t in place. Visit our site for more news www.DailyGlobalDiary.com.

For almost ten years, Chief David Johnston guided the Town of Watertown Fire District with dedication and commitment. According to the district’s Public Information Officer, Warren Day, the decision was “emotional” and “has caused some strife within the department right now.”

1. A decade-of-service interrupted

Johnston was in his role after years of service; colleagues say he earned respect and rapport within the ranks. But this week, the district announced his removal as fire chief, effective immediately. The reason? A certification gap.

2. What triggered the removal?

The issue is straightforward but critical. Johnston holds a “Fire Officer 2” certification. However, when a fire district employs paid, full-time staff, the law demands that the chief hold a higher “Fire Officer 3” certification. That regulation comes from the New York State Office of Fire Prevention and Control (OFPC).

When the Town of Watertown Fire District brought on paid firefighters early last year, that shift triggered the requirement. Once the state agency “caught wind” of the certification shortfall, it ordered the chief’s immediate removal. The local district says they had no choice.

3. The reaction: mixed emotions

“You can’t help how you feel,” Day told media, acknowledging that the decision was hard for many. “There is a lot of mixed emotions. This was a decision that was hard. We didn’t have a choice in this.”

Johnston himself told 7News he understands the rules, but the suddenness still stings. “I understand the law, the rules, and the regulations, but at the same time, I am hurt. This came out of nowhere. I was totally blindsided by it,” he said.

4. What happens next?

Although Johnston is removed from the role of chief, he will remain employed as a paid firefighter within the district. Meanwhile, the duties of fire chief have been temporarily assigned to the district’s three assistant chiefs as the search for a permanently certified replacement begins.

For the community of Watertown, it raises questions: How did a long-time leader end up in a crucial role without the required certification? Who was responsible for oversight? While nothing in the reports indicates any discipline or wrongdoing, the gap in certification underscores how regulations remain enforceable — and how institutions must stay ahead of them.

5. A broader look at fire-service certification

Certification levels such as Fire Officer 2 and Fire Officer 3 exist to ensure that those leading life-saving organizations are trained to meet evolving demands. As fire departments grow and evolve — shifting from volunteer to mixed or full-time paid operations — the regulatory requirements often change. Jurisdictions that fail to align may face mandates from oversight bodies like the NY OFPC. (While not specific to this case, the concept of training and certification in fire prevention is widely discussed. (Wikipedia))

Human side of a regulatory decision

It’s rare to see a leader of nearly ten years removed solely on procedural grounds. For Johnston, the wrench wasn’t a failing in performance — his colleagues appear to have supported his work — but a technicality: the right certification at the right time. His blindsided reaction underscores just how unsettling it is to be removed for something outside of your day-to-day performance.

The district’s public face is two-fold: on one hand, they must comply with state mandates; on the other, they must support morale and cohesion within the department. The vacated fire chief role may prompt more than just an administrative change — it may signal a culture check within the department.

What the Town and community might ask

- How did the oversight happen? Why wasn’t the certification gap discovered earlier, especially as the department transitioned to paid staffing?

- What safeguards will the district implement to prevent a similar situation in future promotions or leadership appointments?

- For the firefighters, what does this mean for morale? When a valued leader is removed, even if legally justified, the ripple effect on team culture can matter.

- Lastly, for residents trusting their fire district in emergencies: how will these changes affect operational readiness and leadership stability?

For the time being, the Town of Watertown Fire District is pushing ahead: the search for a new certified chief is underway, while the assistant chiefs hold the reins. How long the transition lasts and how smooth the change is will speak volumes about the district’s resilience.

If you’re following this story or are interested in how local government, regulatory compliance and public safety intersect — keep an eye on this one.

Visit our site for more news www.DailyGlobalDiary.com

Sports

Lou Holtz confirms return to Fayetteville for Notre Dame vs Arkansas fans say history is repeating itself

Legendary coach Lou Holtz, who once led both Arkansas and Notre Dame, will attend the Week 5 clash between the Fighting Irish and Razorbacks in Fayetteville.

College football is about more than just touchdowns and rivalries — it’s about history, legacy, and the legends who shaped the game. Few names embody that spirit like Lou Holtz.

The 88-year-old coaching icon confirmed through a video message posted by the Notre Dame Club of Arkansas that he will be in attendance at Donald W. Reynolds Razorback Stadium on Saturday, September 27, when Notre Dame takes on Arkansas in a much-anticipated Week 5 non-conference matchup.

ALSO READ : Rockets Guard Fred VanVleet Tears ACL and Likely to Miss 2025-26 Season

A coach who belongs to both schools

Holtz’s connection to both programs is deep. After brief stints at William & Mary and NC State, he took the reins at Arkansas in 1977. His very first season set the tone — an 11-1 record capped off with an Orange Bowl victory. Over seven seasons, he delivered a 60-21-2 record, establishing the Razorbacks as national contenders.

But it was his decade at Notre Dame that turned him into a household name. From 1986 to 1996, Holtz rebuilt the Irish into a powerhouse, culminating in the 1988 national championship season. That undefeated 12-0 run remains one of the proudest chapters in Notre Dame history. To this day, Holtz is one of only three coaches to win at least 100 games with the Irish.

A rivalry inside a friendship

Holtz has also remained in headlines for his fiery back-and-forth with Ryan Day, the head coach of Ohio State. Their exchanges, sometimes testy, have become a quirky subplot in the broader college football world — a reminder that Holtz’s passion for the game hasn’t dimmed even at 88.

The series years in the making

Saturday’s matchup marks the beginning of a long-awaited home-and-home series between Notre Dame and Arkansas. Originally announced back in 2017, the series was set to begin in 2020 at Notre Dame Stadium in South Bend. However, the COVID-19 pandemic forced a reshuffling, pushing that leg of the matchup to 2028.

For fans, that makes this Fayetteville showdown even more meaningful. It’s more than just a football game — it’s the merging of two programs Holtz once guided, with the man himself watching from the stands.

Why it matters

For Arkansas fans, Holtz’s return is a chance to celebrate a golden era when he turned the Razorbacks into a national force. For Notre Dame, his presence recalls the last time the Irish reached the pinnacle of college football. And for the sport as a whole, it’s a reminder that legends never really leave — they simply return at the right time.

As Holtz makes the trip back to Fayetteville, fans from both sides will feel a sense of history in the air. Whether you wear the gold and blue of Notre Dame or the cardinal red of Arkansas, Saturday promises to be more than a game. It’s a reunion with one of college football’s greatest storytellers.

Business & Finance

Dutch firm Amdax raises $23M to chase 1% of Bitcoin supply what it means for global markets

Crypto service provider Amdax launches AMBTS with bold plans to secure 210,000 BTC and list on Amsterdam’s Euronext exchange.

A new player has entered the global race for Bitcoin dominance. Dutch cryptocurrency service provider Amdax has raised €20 million ($23.3 million) to launch a new Bitcoin treasury company, AMBTS, with an audacious goal — to accumulate 1% of all Bitcoin that will ever exist.

ALSO READ : Trump family linked American Bitcoin seals Nasdaq debut after merger with Gryphon shareholders say yes

The announcement, made on Friday, confirmed that multiple investors participated in the initial funding round. AMBTS will operate as an independent, privately held firm with its own governance structure, aiming for a listing on Euronext Amsterdam.

If successful, AMBTS would eventually hold 210,000 BTC, currently valued at over $23 billion, cementing its place among the largest Bitcoin treasuries in the world.

AMBTS intends to leverage the capital markets to increase its Bitcoin holdings and sequentially generate equity appreciation and grow Bitcoin per share for its shareholders,” the company said in its announcement.

Corporate Bitcoin treasuries on the rise

The move by Amdax is part of a wider trend in which corporations have increasingly adopted Bitcoin as a strategic reserve asset. The strategy gained global attention in 2020 when Michael Saylor’s company MicroStrategy (then Strategy) pioneered the corporate Bitcoin treasury model.

Since then, the list of companies holding Bitcoin has expanded far beyond crypto-native firms. Electric vehicle giant Tesla, e-commerce powerhouse MercadoLibre, Brazilian fintech Méliuz, and even Canadian video platform Rumble have disclosed Bitcoin on their balance sheets.

Other notable adopters include Norway’s Aker ASA, Thai telecom Jasmine, U.S. coal producer Alliance, and investment manager Samara based in Malta. Each of these firms has contributed to a shrinking supply of Bitcoin available in circulation, reinforcing the narrative of scarcity that underpins Bitcoin’s market value.

International momentum builds

Amdax’s move comes on the heels of several other ambitious treasury strategies worldwide.

Earlier this week, Metaplanet, a Japanese Bitcoin treasury firm, approved plans to raise nearly $880 million, with most of the capital earmarked for Bitcoin purchases. Meanwhile, French semiconductor company Sequans Communications filed for a $200 million equity offering aimed at expanding its own Bitcoin treasury strategy.

At the same time, MicroStrategy continues to dominate the space. The company currently holds 632,457 BTC, worth more than $69.5 billion, representing more than 3% of all Bitcoin that will ever exist. In August alone, co-founder Michael Saylor hinted at three separate Bitcoin acquisitions, underscoring the company’s relentless pace.

A bold bet from Amsterdam

While $23 million is only a small step compared to MicroStrategy’s multibillion-dollar holdings, Amdax’s vision is clear — establish AMBTS as a European counterpart in the Bitcoin treasury race. Its decision to pursue a listing on Euronext Amsterdam reflects growing institutional demand for Bitcoin exposure in regulated financial markets.

As the firm sets out to acquire 210,000 BTC, one question looms large: can Amdax’s AMBTS secure its place among the titans of Bitcoin accumulation, or will the challenge of competing against giants like MicroStrategy prove too steep?

For now, the launch represents another signal that Bitcoin’s role as a corporate reserve asset is far from slowing down. The fight for who controls the world’s Bitcoin supply has just intensified — and Amdax wants a full 1% stake in it.

-

Entertainment6 days ago

Entertainment6 days agoHe-Man Wears a Suit Now… Nicholas Galitzine’s ‘Masters of the Universe’ Trailer Drops a Shock Fans Didn’t See Coming

-

Entertainment1 week ago

Entertainment1 week agoBrazil Eyes Oscar History Again… ‘The Secret Agent’ Scores Best Picture Nomination as Wagner Moura Stuns Hollywood

-

Entertainment4 days ago

Entertainment4 days ago“Comedy Needs Courage Again…”: Judd Apatow Opens Up on Mel Brooks, Talking to Rob Reiner, and Why Studio Laughs Have Vanished

-

Entertainment1 week ago

Entertainment1 week agoBox Office Shocker as Chris Pratt’s ‘Mercy’ Knocks ‘Avatar 3’ Off the Top but Nature Had Other Plans…

-

Entertainment6 days ago

Entertainment6 days agoOscars Go Global in a Big Way as This Year’s Nominations Signal a New Era: ‘The Academy Is Finally Looking Beyond Hollywood…’

-

Entertainment1 week ago

Entertainment1 week agoMichael Bay Makes a Power Move… Blockbuster Director Signs with CAA in a Deal That’s Turning Heads

-

Entertainment6 days ago

Entertainment6 days ago“Dangerously Kinky… and Darkly Funny”: Olivia Wilde and Cooper Hoffman Push Boundaries in ‘I Want Your Sex’

-

Entertainment1 week ago

Entertainment1 week agoFans Didn’t Expect This Look… Nicholas Galitzine’s Masters of the Universe Trailer Sparks Debate