Automobile

The 10 Most Valuable Car Companies of 2025: EV Titans, Tech Giants, and Global Disruptors Redefine the Road Ahead

Tesla tops the charts, but China’s Xiaomi and BYD climb fast as electric innovation, U.S. tariffs, and shifting market dynamics redraw the auto industry’s future.

The global auto industry in 2025 is undergoing a historic transformation. No longer dominated by legacy giants alone, the top ten most valuable car companies now include technology disruptors, electric vehicle (EV) pioneers, and luxury legends. As the industry pivots toward electrification, autonomy, and smart mobility, market capitalization has become the scoreboard for innovation—and the competition has never been fiercer.

1. Tesla – $1.1 Trillion

Tesla continues to reign supreme. Despite political controversy and competitive pressures, Elon Musk’s EV empire has bounced back after a brief valuation dip. Its refreshed Model Y and Model 3 are designed to counter rising threats from Chinese firms. With the upcoming $25,000 Model Y and progress on Full Self-Driving (FSD) technology, Tesla is eyeing a return to dominance in China and beyond. Musk’s reduced political involvement may also help restore brand confidence.

2. Toyota – $238.7 Billion

Still a pillar of automotive excellence, Toyota retains its second spot even amid headwinds. With $5 billion in forex losses and $1.3 billion in U.S. tariff impacts, the Japanese automaker has doubled down on hybrids and its bZ EV lineup. CEO Koji Sato’s strategy leans on Toyota’s hybrid legacy while steadily electrifying its fleet. The upcoming rugged bZ Woodland SUV is part of its North American push.

3. Xiaomi – $169.3 Billion

A tech giant turned mobility disruptor, Xiaomi’s meteoric rise has reshaped the global auto hierarchy. With over 135,000 SU7 EVs delivered in 2024 and a surge in smart ecosystem integration, Xiaomi is rapidly gaining ground. Its forthcoming YU7 SUV aims to challenge Tesla’s Model Y, while its smartphone manufacturing efficiency gives it unmatched scalability.

4. BYD – $166.1 Billion

Build Your Dreams (BYD) has become Tesla’s fiercest rival in global EV markets. BYD’s vertically integrated model, ultra-fast charging Super E-Platform, and affordable EVs like the e7 are shaking up Latin America and Europe. With no access to U.S. passenger markets due to tariffs, BYD is doubling down on emerging economies with impressive results.

5. Ferrari – $88.9 Billion

Performance meets prestige. Ferrari’s strong Q1 profits and the debut of its first all-electric model—set at a jaw-dropping $535,000—prove the luxury icon still thrives in an EV world. With limited production and rich heritage, Ferrari maintains high margins and global cachet. Its dominance in endurance racing also fuels its aspirational brand.

6. Volkswagen – $57.9 Billion

After swapping ranks with Mercedes-Benz, Volkswagen is in restructuring mode. Tariffs and labor unrest have taken a toll, but its partnership with Rivian and rollout of affordable EVs like the ID.2all show a brand repositioning for the future. Its 2026 China lineup, including 11 new models, aims to recapture lost momentum.

7. Mercedes-Benz – $56.4 Billion

Luxury, electrified. Mercedes-Benz is investing in EQ models like the G580 SUV and CLA electric coupe, but struggles with tariff costs and charging infrastructure gaps. Its expansion of the “Mercedes me Charge” network and the reveal of high-end concepts like the roofless Purespeed speedster aim to revive premium appeal.

8. BMW – $53.1 Billion

BMW’s Neue Klasse platform is set to redefine its electric future, promising 30% longer range and faster charging. With continued success in the Middle East and the upcoming M3 Neue Klasse, the Munich-based automaker is investing in performance, sustainability, and production expansion in China and Hungary.

9. General Motors – $48.4 Billion

GM’s American legacy is being tested. U.S. tariffs, heavy overseas production, and fierce Chinese competition have hit hard. However, with its pivot away from robotaxis and toward expanding Super Cruise across 24 models, and Cadillac entering Formula One in 2026, GM is betting on bold innovation and brand revitalization.

10. Maruti Suzuki – $47.8 Billion

Breaking into the global top 10, India’s Maruti Suzuki reflects the growing power of emerging markets. With increasing EV adoption and domestic dominance, the automaker’s cost-effective models and expanding rural reach have turned it into a key player to watch. Its debut on the leaderboard marks a major milestone for Indian manufacturing.

Conclusion:

As electric and autonomous mobility reshape the global automotive arena, the most valuable car companies of 2025 are no longer just the usual suspects. Tech-first brands like Xiaomi are disrupting the market, while established giants like Toyota and GM are racing to adapt. Amid geopolitical tensions and U.S. tariffs, innovation, agility, and electrification remain the industry’s most valuable assets.

Automobile

“VW Makes a Bold U-Turn… Why the Iconic Scout Is Returning as Hybrids, Not EVs”

In a surprising industry shift, Volkswagen revives its legendary Scout brand with hybrid powertrains — as U.S. consumers turn away from fully electric cars.

For the last several years, major automakers have been racing toward an all-electric future. But in a twist few insiders saw coming, Volkswagen (VW) — one of the world’s largest carmakers — is rewriting its own EV playbook.

The company has decided to revive its classic Scout line not as futuristic electric vehicles, but as rugged, long-range gas-electric hybrids. And if early demand is any measure, the American market is applauding the move louder than anyone expected.

A Comeback Rooted in Consumer Truth

According to Scott Keogh — the CEO of Scout Motors — more than eight out of ten reservation holders chose the plug-in hybrid or extended-range versions instead of pure EVs.

“The market clearly has spoken,” Keogh said during an interview, adding that the hybrid can deliver up to 500 miles on a tank while eliminating typical “EV drama” such as range anxiety or charger shortages.

Keogh, whose professional profile appears on , emphasizes that these buyers don’t want to abandon electrification — they simply want a version that fits American road realities.

Why VW Pivoted Away from Pure EVs

VW acquired Scout when it bought Navistar (the successor to International Harvester, Scout’s original parent) back in 2021. The revival was initially planned as a fully electric rebirth — inspired in part by Ford’s successful comeback with the Bronco SUV.

But with EV demand dipping sharply in the United States — especially after former U.S. President Donald Trump vowed to eliminate the $7,500 EV tax credit, calling it the “EV mandate” — the landscape shifted fast.

Meanwhile, sales of large gasoline SUVs surged, and automakers like General Motors, Stellantis, and Ford scaled back ambitious electric truck plans. Even Tesla’s Cybertruck, despite global hype, has struggled to attract mainstream pickup buyers due to towing-range concerns.

By late 2024, VW realized the writing was on the wall: the Scout revival needed to match the American market’s real sentiment, not its projected one.

What the New Scout Lineup Looks Like

Scout plans to launch two flagship models in 2027:

- Scout Traveler (SUV)

- Scout Terra (pickup truck)

Both are expected to start at around $60,000 — and Keogh insists that the company will not slash this price, even without the EV tax credit.

“We’re not dropping $7,500 off the price,” he said confidently. “We don’t need to.”

The strategy appears to be working: Scout has already received more than 130,000 non-binding reservations, with 73% preferring the SUV.

Could the Pickup Truck Be Canceled?

Interestingly, Keogh didn’t rule out cancelling the Terra pickup if the hybrid truck segment weakens further — a move similar to what Ford is reportedly considering with the F-150 Lightning, as reported by The Wall Street Journal.

“That’s something we could look at,” he admitted. “But not now.”

Audi May Join the Story

The upcoming $2 billion Scout factory in South Carolina may eventually produce vehicles for Audi, VW’s luxury brand. Audi’s CEO has hinted at a U.S.-centric SUV — with reports suggesting it might share the Scout platform.

Keogh neither confirmed nor denied this:

“We’re capable of building for other brands… but Audi would have to answer that.”

Trump’s ‘America First’ Strategy Accidentally Boosted Scout

Ironically, while Trump’s policy shift is hurting other EV makers, it may strengthen Scout’s “Made in America” narrative.

Scout recently announced a $300 million supplier park in South Carolina, reinforcing its Americana identity. Keogh says the tax credit loss only affects Scout for four years and cannot determine the company’s “50-year decision.”

“You don’t build a brand based on money that may or may not exist,” he said.

A Return to Its Roots

Scout hasn’t rolled off an assembly line since 1980. With its revival set for 2027 — this time as a hybrid symbol of American outdoor culture — VW is hoping nostalgia, practicality, and a changing political environment will fuel one of its biggest U.S. comebacks.

Whether consumers embrace the new Scout the way they once cherished the original remains to be seen — but the early numbers suggest VW is finally speaking the language the American market wants to hear.

For more Update ; DALIY GLOBAL DIARY

Automobile

Elon Musk’s $1 Trillion Tesla Pay Deal Sparks Outrage: “He Has the Board Wrapped Around His Finger…”

As Tesla’s record-breaking compensation plan for Elon Musk stirs global debate, critics call it a “corporate capture” while supporters hail it as visionary reward for unmatched innovation.

It was anything but a typical corporate meeting.

On November 6, Elon Musk — the larger-than-life CEO of Tesla, SpaceX, and X — stormed the stage to a funk soundtrack, dancing beside one of Tesla’s Optimus humanoid robots. “Most shareholder meetings are snooze fests,” Musk quipped, “but ours are bangers.”

Behind the theatrics, however, lies a corporate controversy shaking Wall Street: Tesla’s $1 trillion pay deal for Musk — the largest compensation package ever proposed to a CEO in modern history.

A Billion-Dollar Question: Reward or Power Play?

The plan, initially approved years ago and now revived in new form, ties Musk’s earnings to Tesla’s market performance and profitability. In theory, it aligns his incentives with shareholders. In practice, critics argue it demonstrates something far more troubling — what governance experts are calling “corporate capture.”

According to financial analysts, Tesla’s board — composed largely of Musk loyalists and long-time associates — has effectively surrendered oversight to its chief. A report by The Financial Times described the dynamic bluntly:

“Tesla’s board no longer checks Musk’s power — it amplifies it.”

Even The Economist noted that Musk now wields “near-monarchical control” over a publicly traded company, with little resistance to his personal decisions, tweets, or strategic whims.

Investors Divided Over the ‘Musk Empire’

To Musk’s fans, this trillion-dollar pay plan is simply the cost of brilliance. Under his leadership, Tesla became the world’s most valuable automaker, revolutionized electric mobility, and forced legacy carmakers like Ford and General Motors to follow suit.

“Elon Musk has created industries where none existed,” said one venture capitalist on LinkedIn, arguing that such vision deserves an equally extraordinary reward.

But others see it as reckless hero-worship. Corporate watchdogs warn that Tesla’s governance structure risks becoming a “cult of personality” rather than a responsibly managed enterprise. “Tesla is now more Elon than company,” wrote governance expert Lucian Bebchuk from Harvard Law School. “That’s dangerous for shareholders and for capitalism itself.”

Dancing with Robots, Dodging Oversight

Musk’s flair for spectacle — whether launching rockets, trolling competitors on X, or performing at shareholder events — often blurs the line between leadership and showmanship. His latest performance with a robot wasn’t just viral marketing; it was a symbolic reminder of who controls the stage, both literally and figuratively.

Behind the applause, however, investors and regulators are quietly asking: At what point does innovation turn into unchecked dominance?

The Bigger Picture: Corporate Power in the 21st Century

The Musk pay saga isn’t just about one man’s paycheck. It represents a broader trend in modern capitalism — where founders and tech visionaries command immense influence over boards meant to hold them accountable.

As Jeff Bezos, Mark Zuckerberg, and Tim Cook steer trillion-dollar corporations, the balance between innovation and oversight continues to erode. Musk’s trillion-dollar deal, critics say, is simply the most extreme example yet.

The Verdict: “A Banger” or a Boardroom Warning?

For now, Musk remains unfazed. “The shareholders voted. The people have spoken,” he declared with a grin, as applause filled the hall. Yet, beyond the cheers and flashing cameras, the unease lingers.

Is Elon Musk a genius pushing humanity forward — or a corporate emperor rewriting the rules of accountability?

Only time, and Tesla’s next earnings report, will tell.

For more Update http://www.dailyglobaldiary.com

Automobile

The 2026 Cadillac Celestiq Just Got Even Pricier — Here’s Why It Costs Over $400,000 Now

General Motors’ ultra-luxury electric sedan, the Cadillac Celestiq, is getting a massive $60,000 price hike for 2026, with new features and exclusive updates meant to cement its status as America’s answer to Rolls-Royce.

The Cadillac Celestiq, the most luxurious and hand-built model ever produced by General Motors (GM), is about to become even more exclusive. As per a report by Automotive News, the 2026 edition of the Celestiq will now start in the low $400,000 range, marking a steep $60,000 increase over the 2025 version’s $340,000 base price.

A Price Tag That Matches Its Ambition

Cadillac says the price hike reflects the inclusion of the smart glass panoramic roof as standard, along with eight years of connected services. These updates aim to position the Celestiq not just as a car, but as a rolling expression of design, technology, and craftsmanship.

While the figure might sound staggering, Cadillac insists this EV isn’t just transportation — it’s a statement of what American engineering can achieve. “No two Celestiqs will ever be alike,” said a GM executive, referencing the bespoke personalization process that lets buyers hand-pick every inch of the car’s design — from custom paint finishes to hand-stitched interiors and even 3D-printed components.

The Most Technologically Advanced Cadillac Ever

Under its sculpted body, the Celestiq rides on GM’s Ultium Platform — the same electric foundation used in vehicles like the GMC Hummer EV. Its dual-motor setup delivers a staggering 655 horsepower and 640 lb-ft of torque, allowing it to hit 0–60 mph in just 3.7 seconds in Velocity Max mode.

The sedan also features Magnetic Ride Control 4.0, adaptive air suspension, four-wheel steering, and Super Cruise, GM’s semi-autonomous driving system. Inside, you’ll find a pillar-to-pillar HD display, a 38-speaker AKG Studio Reference audio system, and even heated armrests — because why shouldn’t your elbows be as comfortable as the rest of you?

Exclusivity at Its Core

The 2026 Celestiq will continue to be built at the GM Global Technical Center in Warren, Michigan, in extremely limited quantities. Cadillac confirmed that all 25 units of the 2025 model have already been sold, and production for 2026 will remain just as restricted.

Unlike mass-market EVs from Tesla, the Celestiq isn’t meant to dominate sales charts. Instead, it serves as a halo product, showcasing Cadillac’s ultimate potential in electric luxury — a handcrafted rival to the Rolls-Royce Spectre and Bentley Flying Spur.

What Makes It Worth the Money

Every Celestiq undergoes a meticulous artisan-led build process that takes hundreds of hours per unit. Each car can be customized to reflect its owner’s personality — a reflection of Cadillac’s renewed philosophy of “Artful Obsession”.

Owners also receive a dedicated concierge from Cadillac’s bespoke division, ensuring a seamless design-to-delivery experience — something usually reserved for ultra-high-end European marques.

The Bigger Picture

The Celestiq’s steep new pricing signals Cadillac’s confidence in its luxury EV direction. While Mary Barra, GM’s CEO, continues to emphasize an “all-electric future,” the Celestiq stands as a symbol that sustainability and opulence can indeed coexist — at a price, of course.

IMAGE CAPTION:

The 2026 Cadillac Celestiq – GM’s handcrafted luxury EV masterpiece, now starting above $400,000, combines technology, elegance, and exclusivity.

For more Update http://www.dailyglobaldiary.com

-

US News7 days ago

US News7 days ago“She Never Made It Out…” Albany House Fire Claims Woman’s Life as Family Pleads for Help to Bring Her Home

-

Entertainment1 week ago

Entertainment1 week ago“Detective, Psychologist, Anthropologist?” — Inside the Secret World of Casting Directors Behind ‘F1,’ ‘The Smashing Machine’ and ‘Marty Supreme’

-

Entertainment6 days ago

Entertainment6 days agoXG Star Cocona Shares a Brave Truth at 20 — “I Was Born Female, But That Label Never Represented Who I Truly Am…”

-

Entertainment6 days ago

Entertainment6 days agoSamba Schutte Reveals the Surprise Cameo in Pluribus That “Nobody Saw Coming”… and Why John Cena Was Perfect for the Role

-

Entertainment1 week ago

Entertainment1 week agoLegendary Guitarist Steve Cropper Dies at 84… Tributes Pour In for the Soul Icon Behind ‘Green Onions’ and ‘Soul Man’

-

Entertainment7 days ago

Entertainment7 days agoNika & Madison stuns global audiences as director Eva Thomas reveals why “resilience, not fear, drives Indigenous women on the run”

-

Politics5 days ago

Politics5 days ago“Billions and Billions Have Watched Them…” Trump Makes History Hosting Kennedy Center Honors and Praising Stallone, Kiss, and More

-

Entertainment1 week ago

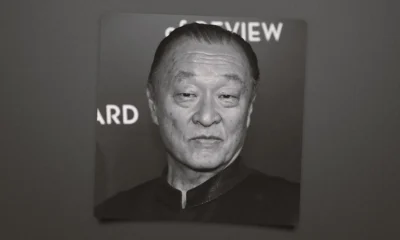

Entertainment1 week agoHollywood Mourns as Cary-Hiroyuki Tagawa Passes Away at 75… Fans Say “Shang Tsung Lives Forever”