Business

Amazon, Google, Microsoft Urge H-1B Workers to Stay in the US Amid New Visa Proclamation – What Does This Mean for Foreign Talent?

“Tech giants Amazon, Google, and Microsoft are advising H-1B visa holders to stay put after Trump’s new visa rule – but what are the potential impacts?”

In a bold move that could shape the future of the U.S. tech industry, Amazon, Google, and Microsoft have reportedly instructed their employees holding H-1B visas to remain in the United States, following President Donald Trump’s controversial new rule on visa applications. According to multiple media outlets, the White House announced a new proclamation on Friday requiring employers to pay a $100,000 fee for new H-1B visa applications, effective from 12:01 AM Eastern on Sunday.

ALSO READ : Coinbase CEO Aims to Replace Traditional Banks with Ambitious Crypto Super App

The announcement has caused a ripple effect in the tech industry, with some of the largest players, including Amazon Google and Microsoft advising employees with H-1B visas to avoid international travel. Those who are already abroad have been encouraged to return to the U.S. before the rule takes effect.

H-1B Visas Under Scrutiny

Business Insider and TechCrunch obtained internal memos from Amazon and Microsoft, while a similar communication was reportedly issued by Google These tech giants, which employ a significant number of foreign workers on H-1B visas, are taking proactive steps to ensure their employees’ compliance with the new proclamation. While Microsoft did not comment, Amazon and Google have yet to respond to further inquiries on the matter.

According to data from the government, Amazon has secured the highest number of H-1B visas for its employees this fiscal year, followed closely by Tata Consultancy Services, Microsoft, Meta, and Apple, with Google rounding out the top six.

Key Changes to H-1B Visa Proclamation

The new rule specifies that the $100,000 fee will only apply to new applicants for the H-1B visa, not to current holders or those seeking visa renewals. However, a White House official clarified in an interview with Axios that the new fee will not impact existing H-1B holders or their ability to leave and re-enter the United States. White House Press Secretary Karoline Leavitt posted on X (formerly Twitter) to reassure H-1B visa holders that their ability to travel abroad and return to the U.S. remains unchanged, stating that “whatever ability they have to do that is not impacted by yesterday’s proclamation.”

Despite this clarification, the tech industry remains on edge about how the $100,000 fee could affect companies’ future hiring strategies, particularly in fields heavily dependent on foreign talent, such as software engineering and AI development. The new rule is expected to create a more challenging environment for startups and smaller companies that might struggle to absorb the additional costs, potentially limiting their ability to compete for top international talent.

The Big Picture: How This Affects U.S. Tech Talent

In the wake of the changes, many are questioning the long-term implications for the U.S. tech industry’s relationship with foreign workers. Amazon, Google, and Microsoft are likely to continue relying on H-1B visa holders for their specialized skill sets, as they represent a significant portion of the workforce in fields like machine learning, cloud computing, and data science. However, with the new $100,000 fee, will these companies reconsider how they approach hiring and visa applications?

Moreover, the pushback against the Trump administration’s latest move highlights the ongoing debate about the role of foreign talent in the U.S. workforce. While tech giants like Amazon and Microsoft have historically supported policies that allow skilled immigrants to contribute to the economy, there is a growing sense of uncertainty over what the future holds for international workers in the U.S.

What’s Next for H-1B Visa Holders?

For now, H-1B visa holders are left in a precarious position, with companies advising caution and emphasizing the need to stay in the U.S. until further clarity emerges. With international travel restrictions in place due to the pandemic and now this new proclamation, foreign workers are under increased pressure to navigate a complex visa system that could affect their careers and livelihood.

While the Trump administration’s policy changes may not immediately impact existing visa holders, the implications for future applications could reshape the landscape of the U.S. tech workforce. Companies like Amazon Google and Microsoft are clearly watching the situation closely, and it remains to be seen how the industry will adjust to these new challenges in the months ahead.

Business

Tesla’s record sales boost Elon Musk past $500 billion… but will the momentum last?

A record-breaking third quarter lifted Tesla’s sales and briefly made Elon Musk the world’s first half-trillionaire, but growing competition and policy changes raise tough questions ahead.

For Tesla and its high-profile CEO Elon Musk, the third quarter of 2025 delivered both a record and a warning. The electric vehicle giant sold 497,099 cars worldwide from July through September, the highest quarterly tally in its history. That surge briefly pushed Musk’s fortune above $500 billion, according to Forbes’ billionaire tracker, making him the first person to ever cross that threshold.

But just as quickly as Tesla stock spiked, the gains began to slip. By Thursday afternoon, Tesla’s shares had dropped nearly 4%, pulling Musk’s net worth back down to $490 billion.

The tax credit rush

The record quarter was driven by a last-minute rush from American buyers before a $7,500 federal EV tax credit expired on September 30. The incentive, introduced under the Biden administration in 2022, was eliminated as part of Donald Trump’s sweeping spending and tax bill earlier this year.

That policy change sparked a short-term boom — but experts warn it could lead to a slump in coming months. Despite the blockbuster quarter, Tesla’s overall year-to-date sales remain 6% lower compared to 2024.

Rivals close in

Tesla wasn’t the only automaker enjoying the tax-credit frenzy. General Motors more than doubled its US EV sales in the same quarter, while Ford reported a 30% jump. Hyundai also doubled its US EV sales, even as it cut prices on its IONIQ 5 by more than $9,000 to stay competitive.

And outside America, Tesla’s biggest threat may come from BYD. The Chinese automaker reported a 31% year-over-year surge in sales, bringing its total EV passenger cars sold in 2025 to 1.6 million, compared to Tesla’s 1.2 million. Despite not selling in the US, BYD is now on track to overtake Tesla as the world’s largest EV maker.

Market share pressures

Tesla’s dominance is no longer assured. Registration data shows the company continues to lose global market share to rivals. While loyal fans still associate Tesla with innovation, some buyers have been turned off by Musk’s outspoken political activity, which has triggered protests in both the US and Europe.

Meanwhile, Chinese automakers like BYD are capturing more of the European EV market, eroding Tesla’s stronghold. And with automakers such as GM, Ford, and Hyundai slashing prices, Tesla faces the pressure of a rapidly commoditizing EV industry.

What’s next?

The third quarter record may end up being a fleeting high point. Analysts say Tesla’s next big challenge will be proving it can sustain growth without the tailwind of government subsidies and while fighting intensifying competition across every major market.

For more Update http://www.dailyglobaldiary.com

Business

UK drivers brace for major tax shake-up as weight-based charges could hit petrol, diesel and EVs alike…

A leading think tank proposes replacing emissions-based road tax with a pay-per-mile system tied to vehicle weight—potentially raising costs for heavy SUVs and electric cars.

British drivers may soon face a radical shift in road taxation, with proposals suggesting that car owners will be charged based on vehicle weight rather than emissions. The plan, set out by the influential Resolution Foundation, could affect millions of motorists—whether they drive petrol, diesel, or electric cars.

Why change the system?

Currently, the UK’s Vehicle Excise Duty (VED) is largely calculated on tailpipe emissions. This means electric vehicles (EVs), which produce zero CO₂ on the road, have often avoided paying road tax altogether. But as EV adoption accelerates, the Treasury is losing billions in revenue once generated from combustion cars.

With EVs projected to dominate new sales in the next decade, policymakers are under pressure to find a sustainable replacement.

The weight-based proposal

The Resolution Foundation suggests a “pay-per-mile” system that scales with a car’s weight. Under the model:

A lightweight EV weighing 1,000kg would pay about 3p per mile.- A mid-sized EV weighing 1,800kg would pay 6p per mile.

- A large SUV or heavy EV above 2,800kg could face up to 9p per mile.

The idea is to link road charges directly to the impact cars have on infrastructure and the environment—heavier vehicles cause more road wear, produce greater tyre and brake pollution, and pose higher risks to pedestrians.

Not just EVs

Importantly, the proposed system would not single out EVs. Traditional petrol and diesel vehicles could also see their flat £195 VED replaced with weight-tiered charges, making it a universal system for all drivers.

Global precedents

Weight-based taxation is not a new idea. Countries like the Netherlands, Estonia, and even New South Wales, Australia, already have similar frameworks in place. Advocates say these systems have improved fairness while discouraging oversized cars.

Government response

The UK Treasury has already signaled its intent to reform motoring taxes, introducing VED for EVs in 2025 and investing over £2 billion to boost greener transport. A spokesperson said policymakers are balancing the need for revenue with incentives for low-emission travel.

Industry experts believe the changes could reshape car-buying behavior. Families may think twice before purchasing bulky SUVs, while manufacturers could feel pressure to design lighter, more efficient EVs.

A fundamental shift

For drivers, the impact could be significant. Someone covering 10,000 miles annually in a heavy EV could face £900 in extra charges. For large SUV owners, this could be even higher.

Critics argue the timing is delicate—just as the UK is trying to encourage EV adoption, heavier taxes may discourage buyers. Supporters counter that fairness and sustainability should guide future policy.

Either way, the shift from emissions-based to weight-based taxation would mark one of the most dramatic changes in UK road policy in decades—and every driver will feel it.

For more Update http://www.dailyglobaldiary.com

Business

Ford CEO Jim Farley warns EV sales could plunge by 50% as $7,500 tax credit ends…

The end of federal incentives may slash U.S. electric vehicle sales in half, forcing Ford and rivals to rethink their EV strategies.

Ford Motor Company CEO Jim Farley has delivered one of the starkest warnings yet for the U.S. electric vehicle (EV) market, saying demand could collapse by nearly 50% once federal tax incentives disappear.

Speaking at Ford’s “Pro Accelerate” event in Detroit on Tuesday, Farley said EV sales, which are currently hovering around a record 10–12% of the U.S. auto market, could sink to just 5% starting next month.

“We’re going to find out in a month. I wouldn’t be surprised if EV sales in the U.S. go down to 5%,” Farley said.

The policy shift

The forecast comes as the $7,500 federal EV incentive ends under the Trump administration’s “One Big Beautiful Bill Act.” The legislation removed blanket EV subsidies but added perks for vehicles assembled in the U.S., regardless of whether they are electric or combustion-based.

The policy change is already altering consumer behavior. Cox Automotive projects EV sales hit a record 410,000 units in Q3 2025, a 21% jump year-on-year, as buyers rushed to take advantage of the expiring credit. But analysts expect demand to slump once the incentive is gone, with many buyers effectively “pulling forward” their purchases.

Expensive cars, cautious buyers

Farley was blunt about the challenge facing automakers:

“Customers are not interested in the $75,000 electric vehicle. They find them interesting. They’re fast, they’re efficient, you don’t go to the gas station, but they’re expensive.”

Ford currently sells models like the F-150 Lightning, which can top $90,000, and the Mustang Mach-E, a crossover positioned against rivals from Tesla and Hyundai. But Farley noted that customers seem more comfortable with hybrids and “partial electrification” for now, calling them “easier for customers to accept.”

Industry-wide ripple effects

The uncertainty could have major consequences for automakers’ massive EV investments. Ford has spent billions on EV development and battery plants across the U.S., but Farley acknowledged those facilities may now face “more stress.”

“We’ll fill them, but it will be more stress, because we had a four-year predictable policy. Now the policy changed. We all have to make adjustments,” he said.

The broader industry is watching closely. Tesla, General Motors, and Hyundai have all banked on rapid EV adoption to justify their expansion plans. The sudden shift could force a rethink in pricing, production, and supply chain strategies.

Skilled trades and the “essential economy”

Farley’s comments came during a Ford-hosted discussion on skilled labor and education. The event drew executives and public officials who emphasized the need for training workers to support both traditional auto manufacturing and the emerging EV ecosystem.

While Farley expressed optimism that EVs will remain “a vibrant industry,” he admitted it will be “way smaller than we thought,” at least in the near term. For automakers, the message is clear: the road to electrification just got a lot bumpier.

For more Update http://www.dailyglobaldiary.com

-

Entertainment1 week ago

Entertainment1 week agoAlyssa Milano removes breast implants says she finally feels free and authentic

-

Sports1 week ago

Sports1 week agoSeattle Mariners end 24 year drought as Cal Raleigh belts No 60 to clinch AL West crown

-

Technology News1 week ago

Technology News1 week agoChina opens Shanghai digital yuan hub to rival US dollar but here’s the bigger plan

-

Sports1 week ago

Sports1 week agoLionel Messi scores twice with assist as Inter Miami crushes New York City FC fans stunned by his masterclass

-

Entertainment6 days ago

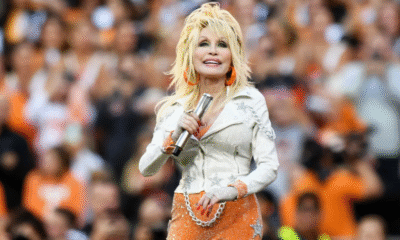

Entertainment6 days agoDolly Parton delays Las Vegas concerts by nine months citing health challenges but promises unforgettable return

-

Politics1 week ago

Politics1 week agoUS Senate to grill Coinbase executive as crypto tax fight heats up next week

-

Entertainment1 week ago

Entertainment1 week agoScarlett Johansson breaks silence on Colin Jost’s SNL future fans surprised by her answer

-

Entertainment6 days ago

Entertainment6 days agoZoey Deutch engaged to comedian Jimmy Tatro after 4 years of dating with romantic beach proposal