Automobile

Car Prices Are Climbing Again in 2025 as Tariffs Hit Buyers and Dealers Alike

With Trump-era tariffs back in play and demand surging, car buyers in 2025 face record prices, limited supply, and tough financing options

If you’ve been thinking about buying a car this year, brace yourself — vehicle prices are climbing again, and the culprit isn’t just inflation. New tariffs implemented by the Trump administration are now playing a direct role in pushing both new and used car prices even higher, adding yet another hurdle for consumers already grappling with steep costs and tight inventory.

When 2025 began, there was cautious optimism that prices — which had soared in the wake of pandemic-era supply chain woes — would continue to cool. But that trend was short-lived. According to Edmunds, the average transaction price for a three-year-old or newer used car climbed to $30,522 in Q1, marking the first time used cars have crossed the $30K threshold since 2023.

New cars aren’t faring much better. Ford has already confirmed price hikes for its popular Mach-E, Maverick, and Bronco Sport models, with increases starting at $600. While these hikes won’t kick in until late June, they’re directly linked to what the company calls “mid-year pricing actions combined with some tariffs.”

So how exactly are these tariffs impacting the car market? As of now, automakers are grappling with a 25% tariff on imported passenger vehicles and parts, along with specific tariffs on content imported from countries like Mexico and Canada. Although some tariffs were briefly blocked by a U.S. trade court in May, a federal appeals court reinstated them the very next day.

As dealerships run through pre-tariff inventory, expect to see sticker prices reflect the new cost burden. Consulting firm Anderson Economic Group predicts tariff-related price hikes of $2,000–$3,000 on low-impact models, and as much as $10,000 or more on high-tariff vehicles.

Even buyers looking for used cars aren’t immune. As new car prices spike, more consumers are shifting their focus to the used car market, tightening supply and causing prices to rise. Cox Automotive’s latest report confirms that used inventory remains below historical norms, despite a slight improvement in May.

But tariffs and supply constraints aren’t the only reason you’re seeing eye-watering price tags at the dealership. Technological upgrades—from giant infotainment screens to advanced driver-assistance systems—have added thousands to base prices. Meanwhile, manufacturers are passing along rising labor and material costs, driven by ongoing inflation.

Since 2019, new car prices have jumped over 22%, according to the Bureau of Labor Statistics’ Consumer Price Index. In April 2025, Kelley Blue Book reported the average new car sale hit $48,699, climbing 2.5% from the previous month. That figure is nearly $11,000 higher than pre-COVID levels.

And if you’re planning to finance your new ride, prepare for more pain. The average new car payment now hovers around $748, according to J.D. Power, while interest rates remain elevated in line with the Federal Reserve’s anti-inflation stance.

In the end, whether you’re eyeing a new SUV or a gently used sedan, 2025 might not be the best year to buy unless you absolutely have to. With tariffs, limited supply, and stubbornly high financing rates, consumers are being squeezed from all angles. And unless something gives—whether in trade policy or the economy—the road ahead for car buyers looks anything but smooth.

Business

Ford CEO Jim Farley warns EV sales could plunge by 50% as $7,500 tax credit ends…

The end of federal incentives may slash U.S. electric vehicle sales in half, forcing Ford and rivals to rethink their EV strategies.

Ford Motor Company CEO Jim Farley has delivered one of the starkest warnings yet for the U.S. electric vehicle (EV) market, saying demand could collapse by nearly 50% once federal tax incentives disappear.

Speaking at Ford’s “Pro Accelerate” event in Detroit on Tuesday, Farley said EV sales, which are currently hovering around a record 10–12% of the U.S. auto market, could sink to just 5% starting next month.

“We’re going to find out in a month. I wouldn’t be surprised if EV sales in the U.S. go down to 5%,” Farley said.

The policy shift

The forecast comes as the $7,500 federal EV incentive ends under the Trump administration’s “One Big Beautiful Bill Act.” The legislation removed blanket EV subsidies but added perks for vehicles assembled in the U.S., regardless of whether they are electric or combustion-based.

The policy change is already altering consumer behavior. Cox Automotive projects EV sales hit a record 410,000 units in Q3 2025, a 21% jump year-on-year, as buyers rushed to take advantage of the expiring credit. But analysts expect demand to slump once the incentive is gone, with many buyers effectively “pulling forward” their purchases.

Expensive cars, cautious buyers

Farley was blunt about the challenge facing automakers:

“Customers are not interested in the $75,000 electric vehicle. They find them interesting. They’re fast, they’re efficient, you don’t go to the gas station, but they’re expensive.”

Ford currently sells models like the F-150 Lightning, which can top $90,000, and the Mustang Mach-E, a crossover positioned against rivals from Tesla and Hyundai. But Farley noted that customers seem more comfortable with hybrids and “partial electrification” for now, calling them “easier for customers to accept.”

Industry-wide ripple effects

The uncertainty could have major consequences for automakers’ massive EV investments. Ford has spent billions on EV development and battery plants across the U.S., but Farley acknowledged those facilities may now face “more stress.”

“We’ll fill them, but it will be more stress, because we had a four-year predictable policy. Now the policy changed. We all have to make adjustments,” he said.

The broader industry is watching closely. Tesla, General Motors, and Hyundai have all banked on rapid EV adoption to justify their expansion plans. The sudden shift could force a rethink in pricing, production, and supply chain strategies.

Skilled trades and the “essential economy”

Farley’s comments came during a Ford-hosted discussion on skilled labor and education. The event drew executives and public officials who emphasized the need for training workers to support both traditional auto manufacturing and the emerging EV ecosystem.

While Farley expressed optimism that EVs will remain “a vibrant industry,” he admitted it will be “way smaller than we thought,” at least in the near term. For automakers, the message is clear: the road to electrification just got a lot bumpier.

For more Update http://www.dailyglobaldiary.com

Automobile

Tesla Model Y Performance shocks with speed upgrades but do families really need a 460bhp SUV?

The revised Model Y Performance brings blistering acceleration, sharper suspension, and subtle design tweaks—but critics ask if it makes sense for the average family buyer.

When Tesla announced the revised Model Y Performance, many assumed it would simply be another power bump on an already rapid electric SUV. On paper, it is: 460bhp, 0-62 mph in 3.5 seconds, and the obligatory “Insane Mode” launch control. But look closer, and there’s more nuance—plus an open question: who exactly needs this much power in a family EV?

A power boost with hidden refinements

The Model Y Performance now uses the LG 5M battery pack borrowed from the Tesla Model 3 Performance. With 79kWh usable capacity, it manages to squeeze in more energy without extra weight, resulting in nearly the same efficiency as the Long Range AWD. Efficiency might not sound as sexy as acceleration, but it matters when you’re ferrying kids to school rather than sprinting down an autobahn.

Alongside the battery, engineers squeezed out 40 extra horsepower over the last version. In today’s EV arms race, that means a 0-62mph sprint in just 3.5 seconds—numbers once reserved for supercars. Stick it in “Insane” mode, and it will repeat that feat multiple times.

Subtle styling, serious aero tweaks

At first glance, the Model Y Performance doesn’t scream transformation. Yes, there’s a new bumper, 21-inch Arachnid 2.0 wheels, a carbon lip spoiler, and glossy black mirrors. But the real story is underneath: the aero work reduces lift by 64% and drag by 10%. Less lift means more stability at speed, while less drag is a welcome efficiency boost. And if you care about details, those flashy red brake calipers? Same as the AWD version—just painted red.

Cabin upgrades and comfort

Inside, Elon Musk’s team focused on refinement. The central touchscreen has grown slightly, now crisper with more pixels. Sportier seats get extra bolstering and electric thigh supports, while carbon trim dots the dashboard and door inserts. Rear passengers aren’t left behind: the 8-inch rear entertainment screen remains, as does the panoramic glass roof.

Noise, vibration, and harshness (NVH) levels have also been significantly improved. On smooth Swiss roads, testers reported cabin noise so low that you could “hear your passenger breathing.” That level of silence in an EV SUV is no small achievement.

Driving experience: intention over fun

Tesla didn’t just rely on raw power. The Y Performance gets adaptive suspension, revised bushings, and reinforced rear bracing. This means sharper handling and smoother ride control. It’s not a night-and-day difference compared to the Long Range AWD, but it does feel more deliberate, more focused. Still, the hefty weight makes quick direction changes less playful. The steering remains accurate but numb, and while braking is solid, it lacks feedback.

At 75% effort, though, the car feels exactly as intended—rapid, secure, and composed. Which, frankly, is what most families will want.

The question of need vs. want

Here’s the rub. The standard Model Y Long Range AWD already does 0-62mph in under five seconds, has slightly more range, and costs about £10,000 less. For daily driving, school runs, and road trips, it might actually be the better choice.

The Performance version feels like an indulgence—a family car with sports car numbers. But will you really unleash 460bhp with children and groceries on board? Probably not.

As one reviewer put it, “The Model Y Performance is brilliant, but it feels surplus to requirements.”

For more Update http://www.dailyglobaldiary.com

Automobile

EV sales skyrocket in the U.S. as buyers race against Sept. 30 tax credit deadline

With federal incentives of up to $7,500 set to expire, Americans rushed to dealerships, sparking a historic surge in electric vehicle sales.

The electric vehicle market in the United States just witnessed a surge unlike anything in recent memory. With federal tax credits for EVs — worth up to $7,500 on new cars and $4,000 on used ones — set to expire on September 30, buyers across the country rushed to secure deals before the clock ran out.

The Republican tax and spending package, passed in July, abruptly brought forward the deadline, creating what analysts have dubbed “the great EV sprint.” To qualify, buyers simply needed a binding contract signed before the deadline, even if delivery of the vehicle was scheduled for later.

“The past couple of weeks — even in the past several days — EV sales just exploded,” said Matt Jones, senior director of industry relations at TrueCar (LinkedIn). “It’s been bonkers.”

Tesla’s countdown and the power of urgency

Some automakers wasted no time amplifying the urgency. Tesla (Wikipedia) prominently featured a ticking countdown clock on its website, reminding buyers of the exact second they had left to lock in their purchase. Other dealers ramped up ad campaigns, targeting consumers who were previously unaware of the tax incentive.

The strategy worked. According to Cox Automotive EV sales in Q3 jumped 21.1% year-over-year, and were 30% higher than in spring 2025. J.D. Power reported that EVs made up over 11% of all U.S. auto sales in August, a figure matched only once before — in December 2024, when buyers rushed to close deals before Donald Trump began his second presidential term.

Used EVs: the hottest ticket under $25k

The frenzy wasn’t limited to new vehicles. Used EVs under $25,000 — the price band eligible for the used tax credit — became the fastest sellers in the market, according to Cars Commerce , parent company of Cars.com.

The surge was so significant that analysts believe it boosted the entire U.S. auto market, with Edmunds forecasting the strongest Q3 new vehicle sales since before the COVID-19 pandemic in 2020.

But will there be an “EV hangover”?

Not everyone is celebrating. Analysts warn that the spike could be followed by a slowdown. “The end of the tax credit created a rush in September, but it could also trigger an EV hangover in the months ahead,” cautioned Ivan Drury of Edmunds.

In other words, consumers who rushed to buy an EV before the deadline likely won’t be shopping again this year, leaving dealerships with fewer potential buyers in the short term.

The Rhodium Group estimates that the early end of the credits could reduce EV sales by 16% to 38% compared to projected growth.

Long-term growth still intact

Despite the uncertainty, long-term EV adoption appears stable. J.D. Power surveys show more than half of new-vehicle shoppers remain interested in going electric within the next year, suggesting that consumer appetite isn’t just tied to government incentives.

Automakers like General Motors and Ford are still heavily investing in EV technology to compete with China’s rapidly expanding market, while also grappling with tariffs and supply chain costs.

The real test, experts say, will be whether automakers can bring down EV prices enough to maintain momentum without federal subsidies. For now, September’s sales boom has shown one thing clearly: when incentives are on the line, American buyers will move fast.

For more Update http://www.dailyglobaldiary.com

-

Entertainment1 week ago

Entertainment1 week agoAlyssa Milano removes breast implants says she finally feels free and authentic

-

Technology News1 week ago

Technology News1 week agoChina opens Shanghai digital yuan hub to rival US dollar but here’s the bigger plan

-

Entertainment6 days ago

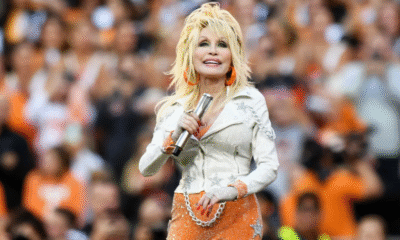

Entertainment6 days agoDolly Parton delays Las Vegas concerts by nine months citing health challenges but promises unforgettable return

-

Entertainment6 days ago

Entertainment6 days agoZoey Deutch engaged to comedian Jimmy Tatro after 4 years of dating with romantic beach proposal

-

Politics6 days ago

Politics6 days agoBarack Obama blasts Trump over Tylenol autism claim calling it ‘violence against truth’ but that’s not all he said…

-

Sports4 days ago

Sports4 days agoTottenham’s Champions League wake-up call… why Spurs must stop looking like a Europa League side

-

Technology1 week ago

Technology1 week agoGoogle shocks crypto world with $3B deal for Cipher Mining stake but here’s the twist

-

Politics1 week ago

Politics1 week agoBarack Obama slams Trump administration over Tylenol autism claim calls it violence against truth