Business & Finance

Will You Really Get a Stimulus Check in 2025? What Trump’s Tariff Rebate Means for Your IRS Refund

Amid tax refund delays and talk of rebates, Americans are asking: Is a fourth stimulus check coming this year?

With the cost of living still weighing heavily on families, many Americans are once again asking the same question: “Will we get another stimulus check?” The answer is complicated — but it hinges on political promises, tax deadlines, and whether Donald Trump’s idea of a tariff rebate ever makes it through Congress.

Trump’s Tariff Rebate Proposal

On July 25, Trump floated the idea of sending taxpayers a rebate check, funded by money generated from tariffs. “We have so much money coming in, we’re thinking about a little rebate,” he said. While the former president also emphasized paying down debt, the mention of rebates instantly sparked comparisons to past stimulus payments.

Trump has pitched other ideas before, including a $5,000 “DOGE dividend” earlier this year in Miami, linked to the Department of Government Efficiency (DOGE) — a proposal associated with Elon Musk’s push to streamline government spending. But so far, no detailed plan has been announced.

Is a Fourth Stimulus Check Coming?

At this point, there is no official indication of a fourth stimulus check being issued. Any such program would need approval from Congress, and with the focus on cost-cutting, a broad payout looks unlikely in 2025.

Table of Contents

The three previous stimulus checks provided relief during the pandemic:

- First round (2020): Up to $1,200 per individual, $2,400 per couple, plus $500 per child under 17.

- Second round (2021): $600 per individual, $1,200 per couple, plus $600 per child.

- Third round (2021): $1,400 per individual, and $1,400 for each dependent.

The filing window for those payments has closed, with April 15, 2025 marking the final deadline for claiming the Recovery Rebate Credit related to the third check.

How to Track Your Tax Refund

While another stimulus check may not be around the corner, millions of Americans are still waiting for their regular tax refunds. The IRS provides a “Where’s My Refund?” tool where filers can track the status of their money.

You’ll need:

- Your Social Security or ITIN number

- Your filing status

- The exact refund amount

Once submitted, the IRS will show whether your return is:

- Return Received – processing has started

- Refund Approved – refund is on the way

- Refund Sent – money has been issued via mail or direct deposit

The IRS says most refunds are processed within three weeks if filed electronically, though paper filings take much longer.

Why Refunds Get Delayed

Refund delays have frustrated many taxpayers. Common reasons include:

- Errors or incomplete information on returns

- Identity theft or fraud alerts

- Adjustments to credits like the Child Tax Credit or Recovery Rebate Credit

- Banks taking extra time to clear deposits

The IRS warns taxpayers not to rely on refund dates for major purchases or bill payments, since processing can take longer than expected.

What Is a Tariff Rebate?

Unlike a discount, a rebate is money returned later, often after a qualifying purchase. In this case, Trump’s idea involves using tariff revenue to issue rebate checks to taxpayers. That could mirror the structure of past stimulus payments — but until Congress moves, it’s only an idea.

Bottom Line

So, will you see a stimulus check in 2025? For now, don’t count on it. While Trump’s rebate idea has generated buzz, nothing has been signed into law. If you’re waiting on money, your best bet is checking the IRS refund tracker and making sure your taxes were filed correctly.

Still, with tariffs, rebates, and political promises making headlines, the possibility of a new relief program remains a storyline worth watching.

For more Update http://www.dailyglobaldiary.com

Sports

Lou Holtz confirms return to Fayetteville for Notre Dame vs Arkansas fans say history is repeating itself

Legendary coach Lou Holtz, who once led both Arkansas and Notre Dame, will attend the Week 5 clash between the Fighting Irish and Razorbacks in Fayetteville.

College football is about more than just touchdowns and rivalries — it’s about history, legacy, and the legends who shaped the game. Few names embody that spirit like Lou Holtz.

The 88-year-old coaching icon confirmed through a video message posted by the Notre Dame Club of Arkansas that he will be in attendance at Donald W. Reynolds Razorback Stadium on Saturday, September 27, when Notre Dame takes on Arkansas in a much-anticipated Week 5 non-conference matchup.

ALSO READ : Rockets Guard Fred VanVleet Tears ACL and Likely to Miss 2025-26 Season

A coach who belongs to both schools

Holtz’s connection to both programs is deep. After brief stints at William & Mary and NC State, he took the reins at Arkansas in 1977. His very first season set the tone — an 11-1 record capped off with an Orange Bowl victory. Over seven seasons, he delivered a 60-21-2 record, establishing the Razorbacks as national contenders.

But it was his decade at Notre Dame that turned him into a household name. From 1986 to 1996, Holtz rebuilt the Irish into a powerhouse, culminating in the 1988 national championship season. That undefeated 12-0 run remains one of the proudest chapters in Notre Dame history. To this day, Holtz is one of only three coaches to win at least 100 games with the Irish.

A rivalry inside a friendship

Holtz has also remained in headlines for his fiery back-and-forth with Ryan Day, the head coach of Ohio State. Their exchanges, sometimes testy, have become a quirky subplot in the broader college football world — a reminder that Holtz’s passion for the game hasn’t dimmed even at 88.

The series years in the making

Saturday’s matchup marks the beginning of a long-awaited home-and-home series between Notre Dame and Arkansas. Originally announced back in 2017, the series was set to begin in 2020 at Notre Dame Stadium in South Bend. However, the COVID-19 pandemic forced a reshuffling, pushing that leg of the matchup to 2028.

For fans, that makes this Fayetteville showdown even more meaningful. It’s more than just a football game — it’s the merging of two programs Holtz once guided, with the man himself watching from the stands.

Why it matters

For Arkansas fans, Holtz’s return is a chance to celebrate a golden era when he turned the Razorbacks into a national force. For Notre Dame, his presence recalls the last time the Irish reached the pinnacle of college football. And for the sport as a whole, it’s a reminder that legends never really leave — they simply return at the right time.

As Holtz makes the trip back to Fayetteville, fans from both sides will feel a sense of history in the air. Whether you wear the gold and blue of Notre Dame or the cardinal red of Arkansas, Saturday promises to be more than a game. It’s a reunion with one of college football’s greatest storytellers.

Business & Finance

Dutch firm Amdax raises $23M to chase 1% of Bitcoin supply what it means for global markets

Crypto service provider Amdax launches AMBTS with bold plans to secure 210,000 BTC and list on Amsterdam’s Euronext exchange.

A new player has entered the global race for Bitcoin dominance. Dutch cryptocurrency service provider Amdax has raised €20 million ($23.3 million) to launch a new Bitcoin treasury company, AMBTS, with an audacious goal — to accumulate 1% of all Bitcoin that will ever exist.

ALSO READ : Trump family linked American Bitcoin seals Nasdaq debut after merger with Gryphon shareholders say yes

The announcement, made on Friday, confirmed that multiple investors participated in the initial funding round. AMBTS will operate as an independent, privately held firm with its own governance structure, aiming for a listing on Euronext Amsterdam.

If successful, AMBTS would eventually hold 210,000 BTC, currently valued at over $23 billion, cementing its place among the largest Bitcoin treasuries in the world.

AMBTS intends to leverage the capital markets to increase its Bitcoin holdings and sequentially generate equity appreciation and grow Bitcoin per share for its shareholders,” the company said in its announcement.

Corporate Bitcoin treasuries on the rise

The move by Amdax is part of a wider trend in which corporations have increasingly adopted Bitcoin as a strategic reserve asset. The strategy gained global attention in 2020 when Michael Saylor’s company MicroStrategy (then Strategy) pioneered the corporate Bitcoin treasury model.

Since then, the list of companies holding Bitcoin has expanded far beyond crypto-native firms. Electric vehicle giant Tesla, e-commerce powerhouse MercadoLibre, Brazilian fintech Méliuz, and even Canadian video platform Rumble have disclosed Bitcoin on their balance sheets.

Other notable adopters include Norway’s Aker ASA, Thai telecom Jasmine, U.S. coal producer Alliance, and investment manager Samara based in Malta. Each of these firms has contributed to a shrinking supply of Bitcoin available in circulation, reinforcing the narrative of scarcity that underpins Bitcoin’s market value.

International momentum builds

Amdax’s move comes on the heels of several other ambitious treasury strategies worldwide.

Earlier this week, Metaplanet, a Japanese Bitcoin treasury firm, approved plans to raise nearly $880 million, with most of the capital earmarked for Bitcoin purchases. Meanwhile, French semiconductor company Sequans Communications filed for a $200 million equity offering aimed at expanding its own Bitcoin treasury strategy.

At the same time, MicroStrategy continues to dominate the space. The company currently holds 632,457 BTC, worth more than $69.5 billion, representing more than 3% of all Bitcoin that will ever exist. In August alone, co-founder Michael Saylor hinted at three separate Bitcoin acquisitions, underscoring the company’s relentless pace.

A bold bet from Amsterdam

While $23 million is only a small step compared to MicroStrategy’s multibillion-dollar holdings, Amdax’s vision is clear — establish AMBTS as a European counterpart in the Bitcoin treasury race. Its decision to pursue a listing on Euronext Amsterdam reflects growing institutional demand for Bitcoin exposure in regulated financial markets.

As the firm sets out to acquire 210,000 BTC, one question looms large: can Amdax’s AMBTS secure its place among the titans of Bitcoin accumulation, or will the challenge of competing against giants like MicroStrategy prove too steep?

For now, the launch represents another signal that Bitcoin’s role as a corporate reserve asset is far from slowing down. The fight for who controls the world’s Bitcoin supply has just intensified — and Amdax wants a full 1% stake in it.

Business & Finance

Trump family linked American Bitcoin seals Nasdaq debut after merger with Gryphon shareholders say yes

Gryphon Digital Mining shareholders approve a reverse merger with American Bitcoin, paving the way for Nasdaq trading under ticker ABTC.

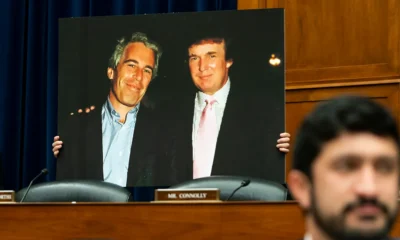

In a move that could reshape the landscape of public Bitcoin mining companies, Gryphon Digital Mining has officially approved its reverse merger with American Bitcoin, a crypto mining venture backed by the family of Donald Trump, the current President of the United States.

ALSO READ : Eliza Labs sues Elon Musk’s xAI after shocking $600000 demand founders call it a betrayal

The decision came after Gryphon shareholders voted in favor of the all-stock merger on Wednesday, with the company confirming the outcome on Friday. The deal sets the stage for a five-to-one reverse stock split and a rebranding of the combined company under the American Bitcoin name. Starting September 2 at 5:00 pm ET, the new entity will trade on Nasdaq under the ticker “ABTC.”

A dramatic shift for Gryphon

The reverse stock split will cut Gryphon’s outstanding shares to just 16.6 million from 82.8 million, streamlining the share base ahead of its new market debut. The merger provides American Bitcoin with a shortcut to public markets, leveraging Gryphon’s existing Nasdaq listing instead of pursuing a separate initial public offering.

Following the announcement, Gryphon’s stock experienced sharp volatility. After soaring 41% on Thursday, shares slid more than 10% on Friday as investors weighed both the excitement and risks of the deal.

The Trump family’s Bitcoin bet

American Bitcoin is no ordinary mining company. Launched in March after a rebrand from American Data Center, the project is spearheaded by Donald Trump Jr. and Eric Trump. The initiative was created in partnership with Hut 8, a well-known digital asset mining and infrastructure provider.

From the outset, American Bitcoin has marketed itself as a “pure-play” Bitcoin miner, with the explicit goal of amassing a substantial BTC treasury. Current disclosures confirm holdings of 215 BTC, but estimates from BitcoinTreasuries.net suggest the company could control as many as 1,941 BTC, positioning it among notable corporate Bitcoin holders.

Strategy and market impact

The merger theoretically fuses Gryphon’s low-cost mining operations with American Bitcoin’s bold accumulation strategy, creating a company designed to appeal to investors seeking both efficiency and aggressive exposure to the world’s largest cryptocurrency.

Industry observers note that this move comes amid a wider trend: public companies expanding their Bitcoin treasuries to hedge against inflation and attract crypto-focused investors. Collectively, listed firms now hold nearly 989,926 BTC, with MicroStrategy — led by Michael Saylor — accounting for almost 64% of the total corporate stash.

What’s next for ABTC?

As the merged entity prepares to debut on Nasdaq, questions remain about how investors will respond to its unique blend of political ties and crypto strategy. The Trump family connection adds a layer of intrigue, especially as regulatory scrutiny around digital assets intensifies in the United States.

For now, the merger signals a bold gamble: blending established infrastructure with an ambitious Bitcoin hoarding plan, all while entering the public markets under one of the most politically charged brand names in crypto history — American Bitcoin (ABTC).

-

Entertainment1 week ago

Entertainment1 week agoAlyssa Milano removes breast implants says she finally feels free and authentic

-

Sports1 week ago

Sports1 week agoSeattle Mariners end 24 year drought as Cal Raleigh belts No 60 to clinch AL West crown

-

Technology News1 week ago

Technology News1 week agoChina opens Shanghai digital yuan hub to rival US dollar but here’s the bigger plan

-

Entertainment6 days ago

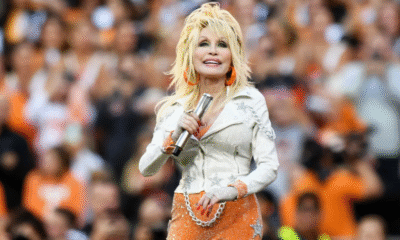

Entertainment6 days agoDolly Parton delays Las Vegas concerts by nine months citing health challenges but promises unforgettable return

-

Politics1 week ago

Politics1 week agoUS Senate to grill Coinbase executive as crypto tax fight heats up next week

-

Sports1 week ago

Sports1 week agoLionel Messi scores twice with assist as Inter Miami crushes New York City FC fans stunned by his masterclass

-

Entertainment1 week ago

Entertainment1 week agoScarlett Johansson breaks silence on Colin Jost’s SNL future fans surprised by her answer

-

Entertainment6 days ago

Entertainment6 days agoZoey Deutch engaged to comedian Jimmy Tatro after 4 years of dating with romantic beach proposal