Business & Finance

Aussie Homeowners Make Bold $200K Mortgage Move After RBA Cuts: ‘Get Ahead Before It’s Too Late’

Aussie Homeowners Make Bold $200K Mortgage Move After RBA Cuts: ‘Get Ahead Before It’s Too Late’. Only 1 in 10 borrowers are cashing in on reduced loan repayments—experts say sticking to higher payments could save homeowners nearly $200,000 over time.

As the Reserve Bank of Australia (RBA) prepares to announce yet another interest rate cut this Tuesday, an intriguing financial trend is quietly reshaping household finances across the country.

Despite three rate cuts already this year, a surprising revelation has emerged from three of the Big Four banks—Commonwealth Bank, NAB, and ANZ: Only 1 in 10 Australian borrowers are choosing to lower their mortgage repayments.

The majority? They’re holding steady—and according to financial experts, that could be a savvy long-term move worth nearly $200,000 in savings.

“It shows only a small percentage of customers are freeing up their cash, while most are maintaining higher repayments,” said Tess Sutherland, General Manager of Commonwealth Bank’s Home Buying team.

So why are so many Aussies resisting the urge to reduce their monthly financial burdens, even as interest rates fall?

‘Getting Ahead’: Why Many Are Choosing to Pay More

Rachel Wastell, a personal finance expert from Mozo, says there’s a strategic play at work here.

“Keeping your repayments the same is a great way to ‘get ahead’ on your loan,” Wastell told Yahoo Finance. “It reduces your loan principal faster and cuts down significantly on interest paid over time.”

Of course, this strategy isn’t for everyone. For those feeling the pressure of rising household costs, Wastell suggests leveraging an offset account—which helps reduce interest while maintaining access to funds when needed.

The trend is particularly strong among borrowers in their 30s and 40s, a demographic juggling mortgages with school-aged kids and high living expenses. According to Commonwealth Bank, this age group is the most likely to lower repayments when given the option—perhaps due to immediate financial demands.

The $200K Opportunity Hiding in Plain Sight

According to CBA’s internal calculations, homeowners with a $500,000 mortgage are saving around $160/month after the February and May cuts. If they maintain pre-cut repayments and benefit from three total cuts—including the expected one this July—they could save up to $200,000 across the life of a 30-year mortgage.

It’s the kind of figure that can significantly accelerate financial freedom, allowing homeowners to reach milestones like early retirement, debt-free living, or investment goals faster than expected.

Still, the figures show that the vast majority—over 90%—of customers with NAB and ANZ are keeping their repayment levels unchanged, with only 10% opting for lower monthly payments since February.

Surprisingly, Westpac, the fourth member of the Big Four, is the only one that automatically lowers repayments for customers paying the minimum amount. Borrowers with the other three banks must contact their provider to opt into a reduced payment schedule.

This silent default may actually be working in borrowers’ favor—forcing them to pay off their loans faster without realizing it.

All Eyes on Tuesday: Will the RBA Cut Again?

Markets are betting with over 90% certainty that the RBA will slice the cash rate down to 3.60% this week—marking the first back-to-back rate cut since the COVID-19 pandemic.

That would bring the total to three interest rate cuts in 2025, and more could be on the horizon.

Here’s how the Big Four banks are predicting the year will unfold:

- CBA & ANZ: Expect two more cuts in July and August

- NAB: Forecasts three cuts in July, August, and November

- Westpac: Projects four total cuts, including the current one

Each cut brings more than just psychological relief. Mozo estimates that a 0.25% reduction on a $500,000 loan (at an average rate of 6.15%) could slash repayments by $76/month—amounting to $918/year in savings for owner-occupiers.

Inflation Slows, But Will Borrowers Act?

Driving these rate cuts is Australia’s falling inflation rate, which dropped to 2.1% in May, down from 2.4% in April. Underlying inflation now sits at 2.4%, the lowest level seen in over three and a half years.

Still, many experts warn that while the RBA is giving breathing room, homeowners shouldn’t assume they’re out of the woods just yet.

“If rates go back up in the next cycle, those who used the cuts to reduce their loan balances will be in a stronger position,” Wastell emphasized.

For now, the message from the banking giants is clear: Whether you choose to bank the savings or pocket the cash, be intentional.

And if you’re in a position to pay more, the math speaks for itself—get ahead now… or potentially leave hundreds of thousands on the table.

Sports

Lou Holtz confirms return to Fayetteville for Notre Dame vs Arkansas fans say history is repeating itself

Legendary coach Lou Holtz, who once led both Arkansas and Notre Dame, will attend the Week 5 clash between the Fighting Irish and Razorbacks in Fayetteville.

College football is about more than just touchdowns and rivalries — it’s about history, legacy, and the legends who shaped the game. Few names embody that spirit like Lou Holtz.

The 88-year-old coaching icon confirmed through a video message posted by the Notre Dame Club of Arkansas that he will be in attendance at Donald W. Reynolds Razorback Stadium on Saturday, September 27, when Notre Dame takes on Arkansas in a much-anticipated Week 5 non-conference matchup.

ALSO READ : Rockets Guard Fred VanVleet Tears ACL and Likely to Miss 2025-26 Season

A coach who belongs to both schools

Holtz’s connection to both programs is deep. After brief stints at William & Mary and NC State, he took the reins at Arkansas in 1977. His very first season set the tone — an 11-1 record capped off with an Orange Bowl victory. Over seven seasons, he delivered a 60-21-2 record, establishing the Razorbacks as national contenders.

But it was his decade at Notre Dame that turned him into a household name. From 1986 to 1996, Holtz rebuilt the Irish into a powerhouse, culminating in the 1988 national championship season. That undefeated 12-0 run remains one of the proudest chapters in Notre Dame history. To this day, Holtz is one of only three coaches to win at least 100 games with the Irish.

A rivalry inside a friendship

Holtz has also remained in headlines for his fiery back-and-forth with Ryan Day, the head coach of Ohio State. Their exchanges, sometimes testy, have become a quirky subplot in the broader college football world — a reminder that Holtz’s passion for the game hasn’t dimmed even at 88.

The series years in the making

Saturday’s matchup marks the beginning of a long-awaited home-and-home series between Notre Dame and Arkansas. Originally announced back in 2017, the series was set to begin in 2020 at Notre Dame Stadium in South Bend. However, the COVID-19 pandemic forced a reshuffling, pushing that leg of the matchup to 2028.

For fans, that makes this Fayetteville showdown even more meaningful. It’s more than just a football game — it’s the merging of two programs Holtz once guided, with the man himself watching from the stands.

Why it matters

For Arkansas fans, Holtz’s return is a chance to celebrate a golden era when he turned the Razorbacks into a national force. For Notre Dame, his presence recalls the last time the Irish reached the pinnacle of college football. And for the sport as a whole, it’s a reminder that legends never really leave — they simply return at the right time.

As Holtz makes the trip back to Fayetteville, fans from both sides will feel a sense of history in the air. Whether you wear the gold and blue of Notre Dame or the cardinal red of Arkansas, Saturday promises to be more than a game. It’s a reunion with one of college football’s greatest storytellers.

Business & Finance

Dutch firm Amdax raises $23M to chase 1% of Bitcoin supply what it means for global markets

Crypto service provider Amdax launches AMBTS with bold plans to secure 210,000 BTC and list on Amsterdam’s Euronext exchange.

A new player has entered the global race for Bitcoin dominance. Dutch cryptocurrency service provider Amdax has raised €20 million ($23.3 million) to launch a new Bitcoin treasury company, AMBTS, with an audacious goal — to accumulate 1% of all Bitcoin that will ever exist.

ALSO READ : Trump family linked American Bitcoin seals Nasdaq debut after merger with Gryphon shareholders say yes

The announcement, made on Friday, confirmed that multiple investors participated in the initial funding round. AMBTS will operate as an independent, privately held firm with its own governance structure, aiming for a listing on Euronext Amsterdam.

If successful, AMBTS would eventually hold 210,000 BTC, currently valued at over $23 billion, cementing its place among the largest Bitcoin treasuries in the world.

AMBTS intends to leverage the capital markets to increase its Bitcoin holdings and sequentially generate equity appreciation and grow Bitcoin per share for its shareholders,” the company said in its announcement.

Corporate Bitcoin treasuries on the rise

The move by Amdax is part of a wider trend in which corporations have increasingly adopted Bitcoin as a strategic reserve asset. The strategy gained global attention in 2020 when Michael Saylor’s company MicroStrategy (then Strategy) pioneered the corporate Bitcoin treasury model.

Since then, the list of companies holding Bitcoin has expanded far beyond crypto-native firms. Electric vehicle giant Tesla, e-commerce powerhouse MercadoLibre, Brazilian fintech Méliuz, and even Canadian video platform Rumble have disclosed Bitcoin on their balance sheets.

Other notable adopters include Norway’s Aker ASA, Thai telecom Jasmine, U.S. coal producer Alliance, and investment manager Samara based in Malta. Each of these firms has contributed to a shrinking supply of Bitcoin available in circulation, reinforcing the narrative of scarcity that underpins Bitcoin’s market value.

International momentum builds

Amdax’s move comes on the heels of several other ambitious treasury strategies worldwide.

Earlier this week, Metaplanet, a Japanese Bitcoin treasury firm, approved plans to raise nearly $880 million, with most of the capital earmarked for Bitcoin purchases. Meanwhile, French semiconductor company Sequans Communications filed for a $200 million equity offering aimed at expanding its own Bitcoin treasury strategy.

At the same time, MicroStrategy continues to dominate the space. The company currently holds 632,457 BTC, worth more than $69.5 billion, representing more than 3% of all Bitcoin that will ever exist. In August alone, co-founder Michael Saylor hinted at three separate Bitcoin acquisitions, underscoring the company’s relentless pace.

A bold bet from Amsterdam

While $23 million is only a small step compared to MicroStrategy’s multibillion-dollar holdings, Amdax’s vision is clear — establish AMBTS as a European counterpart in the Bitcoin treasury race. Its decision to pursue a listing on Euronext Amsterdam reflects growing institutional demand for Bitcoin exposure in regulated financial markets.

As the firm sets out to acquire 210,000 BTC, one question looms large: can Amdax’s AMBTS secure its place among the titans of Bitcoin accumulation, or will the challenge of competing against giants like MicroStrategy prove too steep?

For now, the launch represents another signal that Bitcoin’s role as a corporate reserve asset is far from slowing down. The fight for who controls the world’s Bitcoin supply has just intensified — and Amdax wants a full 1% stake in it.

Business & Finance

Trump family linked American Bitcoin seals Nasdaq debut after merger with Gryphon shareholders say yes

Gryphon Digital Mining shareholders approve a reverse merger with American Bitcoin, paving the way for Nasdaq trading under ticker ABTC.

In a move that could reshape the landscape of public Bitcoin mining companies, Gryphon Digital Mining has officially approved its reverse merger with American Bitcoin, a crypto mining venture backed by the family of Donald Trump, the current President of the United States.

ALSO READ : Eliza Labs sues Elon Musk’s xAI after shocking $600000 demand founders call it a betrayal

The decision came after Gryphon shareholders voted in favor of the all-stock merger on Wednesday, with the company confirming the outcome on Friday. The deal sets the stage for a five-to-one reverse stock split and a rebranding of the combined company under the American Bitcoin name. Starting September 2 at 5:00 pm ET, the new entity will trade on Nasdaq under the ticker “ABTC.”

A dramatic shift for Gryphon

The reverse stock split will cut Gryphon’s outstanding shares to just 16.6 million from 82.8 million, streamlining the share base ahead of its new market debut. The merger provides American Bitcoin with a shortcut to public markets, leveraging Gryphon’s existing Nasdaq listing instead of pursuing a separate initial public offering.

Following the announcement, Gryphon’s stock experienced sharp volatility. After soaring 41% on Thursday, shares slid more than 10% on Friday as investors weighed both the excitement and risks of the deal.

The Trump family’s Bitcoin bet

American Bitcoin is no ordinary mining company. Launched in March after a rebrand from American Data Center, the project is spearheaded by Donald Trump Jr. and Eric Trump. The initiative was created in partnership with Hut 8, a well-known digital asset mining and infrastructure provider.

From the outset, American Bitcoin has marketed itself as a “pure-play” Bitcoin miner, with the explicit goal of amassing a substantial BTC treasury. Current disclosures confirm holdings of 215 BTC, but estimates from BitcoinTreasuries.net suggest the company could control as many as 1,941 BTC, positioning it among notable corporate Bitcoin holders.

Strategy and market impact

The merger theoretically fuses Gryphon’s low-cost mining operations with American Bitcoin’s bold accumulation strategy, creating a company designed to appeal to investors seeking both efficiency and aggressive exposure to the world’s largest cryptocurrency.

Industry observers note that this move comes amid a wider trend: public companies expanding their Bitcoin treasuries to hedge against inflation and attract crypto-focused investors. Collectively, listed firms now hold nearly 989,926 BTC, with MicroStrategy — led by Michael Saylor — accounting for almost 64% of the total corporate stash.

What’s next for ABTC?

As the merged entity prepares to debut on Nasdaq, questions remain about how investors will respond to its unique blend of political ties and crypto strategy. The Trump family connection adds a layer of intrigue, especially as regulatory scrutiny around digital assets intensifies in the United States.

For now, the merger signals a bold gamble: blending established infrastructure with an ambitious Bitcoin hoarding plan, all while entering the public markets under one of the most politically charged brand names in crypto history — American Bitcoin (ABTC).

-

Entertainment1 week ago

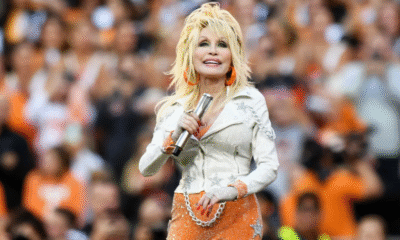

Entertainment1 week agoDolly Parton delays Las Vegas concerts by nine months citing health challenges but promises unforgettable return

-

Entertainment1 week ago

Entertainment1 week agoZoey Deutch engaged to comedian Jimmy Tatro after 4 years of dating with romantic beach proposal

-

Politics1 week ago

Politics1 week agoBarack Obama blasts Trump over Tylenol autism claim calling it ‘violence against truth’ but that’s not all he said…

-

Entertainment4 days ago

Entertainment4 days agoSurvivor Season 49 episode 2 shocker Kele tribe loses again and fans stunned by who went home

-

Sports3 days ago

Sports3 days ago‘Silent killer’ Cam Schlittler stuns Red Sox as Yankees rookie makes history with 12 strikeouts

-

Crime & Justice5 days ago

Crime & Justice5 days agoProsecutors demand 11 years for Diddy after shocking trial says Cassie’s testimony revealed dark truth

-

Sports5 days ago

Sports5 days agoTottenham’s Champions League wake-up call… why Spurs must stop looking like a Europa League side

-

Sports2 days ago

Sports2 days agoShohei Ohtani finally pitches in MLB playoffs after 2,746 days… will this be the moment that defines Dodgers vs Phillies?