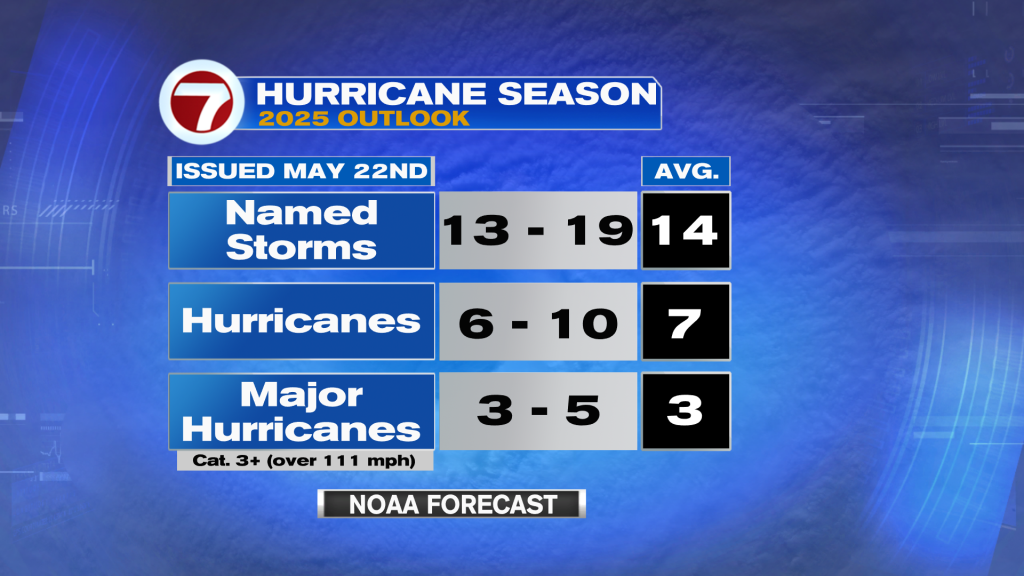

Weather

South Florida Faces Stormy Start to Hurricane Season With Heavy Rain and Strong Winds

Tropical moisture fuels thunderstorms and isolated wind gusts as drought conditions persist across Broward and Miami-Dade Counties

Hurricane season has officially kicked off in South Florida, bringing with it a dramatic start marked by heavy thunderstorms, gusty winds, and the potential for localized flooding. On Sunday, strong storm systems rolled through the region, fueled by trapped tropical moisture hovering over the area.

Residents in Broward County’s Margate neighborhood felt the impact firsthand, as wind gusts estimated near 70 mph swept through parts of the city, leaving property damage in their wake. Areas along 63rd Avenue and Royal Palm experienced some of the most intense winds, prompting weather officials to issue a marginal risk alert — the lowest of a five-level scale — for severe weather across South Florida.

Forecasters warn that this unsettled weather pattern will continue into Monday, Tuesday, and early Wednesday, with rainfall totals ranging from 2 to 4 inches, and some pockets possibly receiving up to 6 inches. This steady barrage of rain comes as a mixed blessing for Broward and Miami-Dade Counties, which are still grappling with moderate to extreme drought conditions following an unusually dry dry-season.

The National Hurricane Center confirms that, despite the turbulent weather, the Atlantic Ocean currently shows no signs of imminent tropical cyclone development for the coming week. However, South Floridians should prepare for clusters of storm clouds moving eastward across the peninsula, bringing more rain, lightning, and gusty winds.

The weather service cautions that while most areas might see less than an inch of rain on average, localized spots — particularly in Fort Lauderdale, Miami, and West Palm Beach — could experience heavier downpours. Fort Lauderdale and Miami could see up to 3 inches of rainfall, with West Palm Beach expecting about 2 inches.

This early season weather pattern raises concerns not only for flood risks but also for increased lightning hazards. Local authorities urge residents to stay alert and follow the latest weather updates through trusted sources like Local 10 News and the Weather Authority’s live radar and hourly forecasts.

As the stormy season begins, South Florida braces for a wet and windy week ahead, underscoring the unpredictable nature of hurricane season’s early days.

Weather

Weather Alert: First Snowfall of the Season Slows DC Commute, Triggers Widespread School Closures and Delays

Up to 3 inches of snow fell across the D.C. region Friday morning, causing hazardous roads, multiple crashes, and significant disruptions for schools and commuters.

Storm Team4 declared a Weather Alert Friday morning as the D.C. metro area woke up to its first widespread snowfall of the season — a system that brought 1 to 3 inches to many neighborhoods and created a messy, slow-moving commute across the region.

By 8 a.m., large, fluffy snowflakes were falling steadily over downtown Washington, suburban Maryland, and northern Virginia. The snowfall wasn’t particularly heavy, but its timing — right in the middle of the morning rush — led to difficult travel conditions and numerous disruptions.

Meteorologist Chuck Bell emphasized that timing, not totals, was the core issue.

“It’s not the amount of snow, it’s when it’s happening,” Bell said, as delays mounted across major highways and school systems.

Roads Treated, but Crashes and Congestion Build

Road crews pretreated major routes Thursday evening, yet snow still caused slick spots and slow traffic from the earliest morning hours.

- Snow was sticking along Interstate 95 near Stafford, Virginia, as early as 5 a.m.

- Fredericksburg crews reported treating icy patches throughout the morning.

- In La Plata, Maryland, flakes piled up quickly, reducing visibility.

Several crashes were reported across Montgomery County, including a major incident that blocked all northbound lanes of I-270 at Maryland Route 189, forcing traffic onto the shoulder and causing heavy delays.

In Solomons, Maryland, the Thomas Johnson Bridge was shut down in both directions after multiple vehicle crashes, according to Calvert County officials.

When Will the Snow End?

Snow will taper into flurries through Friday afternoon, ending around sunset for most locations.

Cold weekend temperatures — running 20 degrees below normal — will help the snow stick around, especially on untreated surfaces.

The National Weather Service issued a winter weather advisory for the DC metro through 4 p.m., although meteorologists expect it may be canceled early as the system moves out.

Residents are urged to allow extra travel time, consider public transit, or work remotely if possible.

School Closures and Delays Across the Region

The snowfall prompted widespread closures and delays, particularly south of the District.

Virginia – Schools CLOSED

- Culpeper County

- Fauquier County

- Fredericksburg

- Loudoun County

- Manassas Park

- Orange County

- Page County

- Shenandoah County

- Spotsylvania County

- Stafford County

Virginia – Two-Hour DELAY

- Alexandria Public Schools

- Falls Church City Public Schools

- Fairfax County Public Schools

Maryland – Schools CLOSED

- Prince George’s County Public Schools

Maryland – Two-Hour DELAY

- Anne Arundel County Public Schools

- Calvert County Public Schools

Maryland – On Time

- Montgomery County Public Schools (advising extra caution for drivers and students)

Residents can continue checking the school closings page for updated schedules.

How Local Agencies Prepared

Washington, D.C.

- Activated an Extreme Cold Alert through 9 a.m. Friday

- Deployed the District Snow Team to pretreat and salt major roads

- Encourages residents to call 202-399-7093, 311, or 911 if someone needs shelter or appears in danger

Virginia

- VDOT pretreated major roads Thursday

- Drivers are urged to slow down and give road crews plenty of space

Maryland

- The State Highway Administration applied pretreatment on interstates

- Snow plows and salt trucks were active before and during the morning commute

- Montgomery County DOT focused on emergency and priority routes

Impact Beyond the Metro Area

Not all regions were affected equally.

Areas farther out, such as:

- Frederick County

- Washington County

- Far western Maryland

…may see little or no accumulation.

But for those in Lower Montgomery County, Prince George’s County, and Northern Virginia, extra caution was essential as the morning commute remained slow and hazardous.

World News

7 Key Figures Who Helped Expose Australia’s ‘Cruel and Crude’ Robodebt Scheme

From whistleblowers to journalists, a new documentary reveals how the Robodebt scandal was finally brought down.

When Guardian Australia first broke the story in late 2016, the Robodebt scheme was just beginning to unravel. At the time, the Coalition government dismissed concerns, labeling the investigation as left-leaning journalism. Almost a decade later, those early warnings have now been immortalized in a powerful new documentary, The People vs Robodebt, airing on SBS.

The three-part hybrid documentary-drama goes beyond headlines. It highlights not only the illegal nature of the scheme but also the extraordinary people who risked their careers and reputations to expose it.

A Scheme Built on “Income Averaging”

The Robodebt program, formally introduced in 2015, used automated income averaging to calculate supposed debts owed to Centrelink recipients. Rather than using actual earnings data, the system averaged annual income, leading to incorrect—and often devastating—debt notices.

In July 2023, the Royal Commission condemned the scheme as “crude and cruel,” “neither fair nor legal,” and a “costly failure of public administration.” The fallout was immense: not only did it devastate thousands of welfare recipients, but it also shattered public trust in automated governance.

The Journalists Who Wouldn’t Let Go

At the center of the exposé was Christopher Knaus, a reporter for Guardian Australia. Branded as a “leftwing journo” by government strategists, Knaus persisted, publishing exclusives that revealed how deeply flawed the system was. His reporting was supported by tips from victims and whistleblowers within Centrelink itself.

Knaus was later joined by Luke Henriques-Gomes, whose sustained coverage helped keep the story in the spotlight. Together, they gave a voice to victims and challenged the government narrative pushed by more compliant media outlets.

A Media Insider Turns

The documentary also features Rachelle Miller, a former Liberal Party of Australia staffer. Initially responsible for framing Knaus as partisan, Miller later admitted she realized the scheme was unfair. She now acknowledges how government-friendly outlets, including News Corp tabloids and The Australian, were fed selective stories to protect the Coalition’s welfare crackdown.

Victims Who Refused to Be Silent

Behind the statistics are real human tragedies. Among the most heartbreaking is the story of Rhys Cauzzo, a 28-year-old part-time florist who took his own life after being pursued for $17,000 in alleged debts. His mother, Jenny Miller, has become one of the most powerful voices in the fight against Robodebt.

Shockingly, after Rhys’s death, the Department of Human Services released his personal Centrelink information to the media in an attempt to smear him. The royal commission later confirmed that Cauzzo’s debt was unlawfully calculated—just like the hundreds of thousands of others.

Activists and Lawyers

Digital activists and welfare advocacy groups amplified victim stories online, sparking grassroots outrage. Lawyers played a critical role too, spearheading a class action that ultimately forced the government to settle. Earlier this month, the government agreed to pay $475 million in additional compensation to around 450,000 victims, marking the largest class action settlement in Australian history.

The Role of Documentary Storytelling

Executive producer Michael Cordell explains why he felt compelled to revisit the scandal. “It was a morally bankrupt scheme,” he said. “But despite the devastation it caused, it hadn’t caught the wider public imagination. We wanted to change that.”

Using dramatized scenes alongside interviews, The People vs Robodebt ensures the human toll is front and center. It’s not just policy failure—it’s about empathy, or the lack thereof, in the political system.

Why This Story Still Matters

The Robodebt scandal is more than a cautionary tale about flawed automation. It’s a stark reminder of what happens when governments prioritize cost-cutting over compassion. It also shows the power of journalism, whistleblowing, and persistence in the face of official denial.

For Australians who endured harassment and wrongful debt collection, this documentary isn’t just about the past—it’s about justice, accountability, and preventing future failures.

Final Word

At its core, The People vs Robodebt is about ordinary people standing against a powerful government apparatus. From journalists like Knaus and Henriques-Gomes, to grieving parents like Jenny Miller, to insiders like Rachelle Miller, their courage collectively dismantled a system described as “neither fair nor legal.”

All three episodes of The People vs Robodebt are now streaming on SBS On Demand, airing weekly at 7.30 pm.

For the latest updates on this and other global stories, visit www.DailyGlobalDiary.com.

World News

Robodebt Scandal Victims Win Record $548.5m Deal Taking Total Payout to $2.4bn

The Albanese government settles historic appeal, marking justice for 450,000 Australians hit by the illegal Centrelink scheme.

In what has been described as the largest class action settlement in Australian history, the federal government has agreed to pay $475 million in additional compensation to victims of the notorious Robodebt scandal. The deal, announced on Thursday, pushes the total financial redress for victims past an astonishing $2.4 billion.

The Robodebt scheme, launched under Australia’s Coalition government between 2015 and 2019, used automated technology to falsely accuse more than 443,000 welfare recipients of underreporting their income. Many were left traumatised, battling debt notices that were later found to be unlawful.

A Landmark Settlement

The new agreement settles Knox v Commonwealth, an appeal filed after the Royal Commission into Robodebt exposed fresh evidence that government officials knew the system was unlawful yet allowed it to continue.

The $548.5 million total package now includes:

- $475 million in fresh compensation.

- $112 million from the original 2020 settlement.

- $1.76 billion in debts that were forgiven, cancelled, or repaid by the government.

- $60 million allocated for administering the scheme.

- $13.5 million to cover reasonable legal costs.

For the roughly 450,000 Australians affected, the settlement is both financial relief and moral vindication.

Voices of the Victims

One of the applicants, Felicity Button, described the outcome as a turning point for fairness in Australia.

“For the first time, I think in my whole life, I can say that there was a bit of fairness – not just justice – in our system,” Button said.

Many victims endured years of stress, depression, and even financial ruin because of the automated notices. Some families linked the scheme to tragic outcomes, sparking nationwide outrage.

Government’s Response

The Attorney General Michelle Rowland, speaking on behalf of the Albanese Labor government, said settling was “the just and fair thing to do.”

She acknowledged that the Royal Commission led by Catherine Holmes had branded Robodebt a “crude and cruel mechanism” and a “costly failure of public administration.”

“Today’s settlement demonstrates the Albanese government’s ongoing commitment to addressing the harms caused to hundreds of thousands of vulnerable Australians by the former Liberal government’s disastrous scheme,” Rowland said.

Legal Victory

Peter Gordon of Gordon Legal, the firm that spearheaded the class action, called the settlement “vindication and validation.”

“Today is also one more vindication of the principle that Australia remains a nation ruled by laws and not by kings. Laws which even hold the government accountable,” Gordon said during a press conference.

He urged victims to register with the firm for updates, promising payments within six months of federal court approval.

Political Repercussions

The scandal has left deep political scars. The Greens spokesperson for social services, Penny Allman-Payne, welcomed the compensation but argued that the government should go further by abolishing what she described as “cruel compliance targets”.

The settlement comes just as new reforms were announced for Centrelink. Debts smaller than $250 will now be waived, and compensation of up to $600 will be offered to those affected by invalid income apportionment methods.

Human and Economic Cost

The Robodebt saga has been more than a legal or political scandal; it has been a humanitarian crisis. The Royal Commission’s findings laid bare how thousands of ordinary Australians were unfairly harassed.

Some victims reported that the constant debt letters made them feel like criminals. Others said the ordeal eroded trust in public institutions. The commission’s conclusion—that Robodebt was “neither fair nor legal”—is now permanently etched into Australian history.

Looking Ahead

The settlement closes one of the darkest chapters in Australia’s welfare policy. Yet for many victims, wounds remain raw. While compensation provides recognition, it cannot undo the stress and trauma caused.

Still, this record-breaking settlement sends a clear message: governments must be held accountable, and automation cannot replace fairness in dealing with society’s most vulnerable.

For now, the victims of Robodebt can finally breathe a sigh of relief knowing their voices have been heard, and their suffering formally acknowledged.

Stay updated with Daily Global Diary for more breaking news and in-depth analysis from Australia and beyond.

-

US News6 days ago

US News6 days ago“She Never Made It Out…” Albany House Fire Claims Woman’s Life as Family Pleads for Help to Bring Her Home

-

Entertainment1 week ago

Entertainment1 week ago“Detective, Psychologist, Anthropologist?” — Inside the Secret World of Casting Directors Behind ‘F1,’ ‘The Smashing Machine’ and ‘Marty Supreme’

-

Entertainment5 days ago

Entertainment5 days agoXG Star Cocona Shares a Brave Truth at 20 — “I Was Born Female, But That Label Never Represented Who I Truly Am…”

-

Entertainment5 days ago

Entertainment5 days agoSamba Schutte Reveals the Surprise Cameo in Pluribus That “Nobody Saw Coming”… and Why John Cena Was Perfect for the Role

-

Entertainment1 week ago

Entertainment1 week agoLegendary Guitarist Steve Cropper Dies at 84… Tributes Pour In for the Soul Icon Behind ‘Green Onions’ and ‘Soul Man’

-

Entertainment6 days ago

Entertainment6 days agoNika & Madison stuns global audiences as director Eva Thomas reveals why “resilience, not fear, drives Indigenous women on the run”

-

Politics4 days ago

Politics4 days ago“Billions and Billions Have Watched Them…” Trump Makes History Hosting Kennedy Center Honors and Praising Stallone, Kiss, and More

-

Entertainment1 week ago

Entertainment1 week agoHollywood Mourns as Cary-Hiroyuki Tagawa Passes Away at 75… Fans Say “Shang Tsung Lives Forever”