Crypto

Bitcoin mining stocks explode up to 28 percent in surprise rally after US job report stuns Wall Street

Crypto miners like Riot and Hive post double-digit gains as strong US labor data boosts confidence in a soft-landing economy.

Bitcoin mining stocks just pulled off a surprise power play on Wall Street. Companies like Riot Platforms (RIOT), Hive Digital (HIVE), Hut 8 (HUT8), MARA Holdings (MARA), and Bitfarms (BITF) saw weekly gains ranging from 13% to 28%, posting one of their strongest four-day stretches this year.

The rally, which unfolded just ahead of the July 4th holiday weekend, was driven by renewed confidence in the U.S. economy after a better-than-expected jobs report signaled strength in the labor market. While Thursday saw some stocks cool off slightly, the surge was enough to turn heads across both crypto and traditional finance sectors.

“The broader macro picture remains supportive of rate cuts,” said Matt Mena, a strategist at 21Shares, referencing the Federal Reserve’s potential moves later in the year.

Mining Stocks Mirror Wall Street Optimism

The U.S. Bureau of Labor Statistics reported 147,000 new jobs in June and a drop in unemployment to 4.1% — both figures exceeding analyst forecasts. While workforce participation hit its lowest point since 2022, economists suggest the dip could be linked to recent immigration enforcement tightening the labor pool.

The rally wasn’t just isolated to crypto miners. The S&P 500 and Nasdaq Composite Index also reached new all-time highs during the abbreviated session, signaling growing optimism that the U.S. Federal Reserve may manage a “soft landing” without aggressive interest rate hikes.

VanEck’s Crypto ETF and Coinbase Join the Surge

The VanEck Digital Transformation ETF, which tracks 24 crypto-related companies including Coinbase (COIN), Circle, MicroStrategy (MSTR), and several miners, rose as much as 3.2% on Thursday, further affirming investor interest in blockchain infrastructure plays.

Even as the rally cooled by Thursday afternoon, the sentiment remained bullish.

“This is exactly the kind of macro environment where digital assets tend to thrive,” Mena added, pointing to regulatory clarity efforts like the Market Structure Bill and the GENIUS Act, which aim to streamline rules for crypto market players.

Tech

CoinFund President Slams Basel Rules for Quietly Crippling Crypto Growth

CoinFund president Chris Perkins warns that strict Basel Committee capital rules are driving banks away from crypto, creating a subtle but effective blockade.

Global banking regulators may not be banning crypto outright, but they might be silently choking its growth through rigid capital rules. That’s the warning from Chris Perkins, president of digital investment firm CoinFund, who says current banking standards are making cryptocurrencies “too costly to hold” for major financial institutions.

The Basel Committee on Banking Supervision (BCBS), which designs international banking standards, requires banks to set aside high capital reserves when dealing with crypto assets. According to Perkins, these rules drastically reduce a bank’s return on equity (ROE)—a key measure of profitability—making the economics of offering crypto services unattractive.

“It’s a different type of chokepoint,” Perkins told Cointelegraph. “It’s not direct. It’s a very nuanced way of suppressing activity by making it so expensive for the bank to do activities that they’re just like, ‘I can’t.’”

He added that banks naturally steer capital into high-ROE businesses rather than low-ROE ones, meaning that under the current Basel rules, crypto becomes a financial non-starter for traditional institutions.

Clash Between Old Finance and New Networks

This isn’t the first time Perkins has clashed with regulators. Back in April, he criticized the Bank for International Settlements (BIS)—the so-called “central bank of central banks”—for pushing know-your-customer (KYC) rules and legacy compliance standards onto decentralized finance (DeFi) protocols and stablecoins.

Perkins argued that such measures undermine the core principles of permissionless networks, where anyone can transact without centralized gatekeepers.

He further warned that the real risk to the financial system lies in the asymmetry between old and new infrastructures.

BIS Pushes CBDCs, Rejects Stablecoins

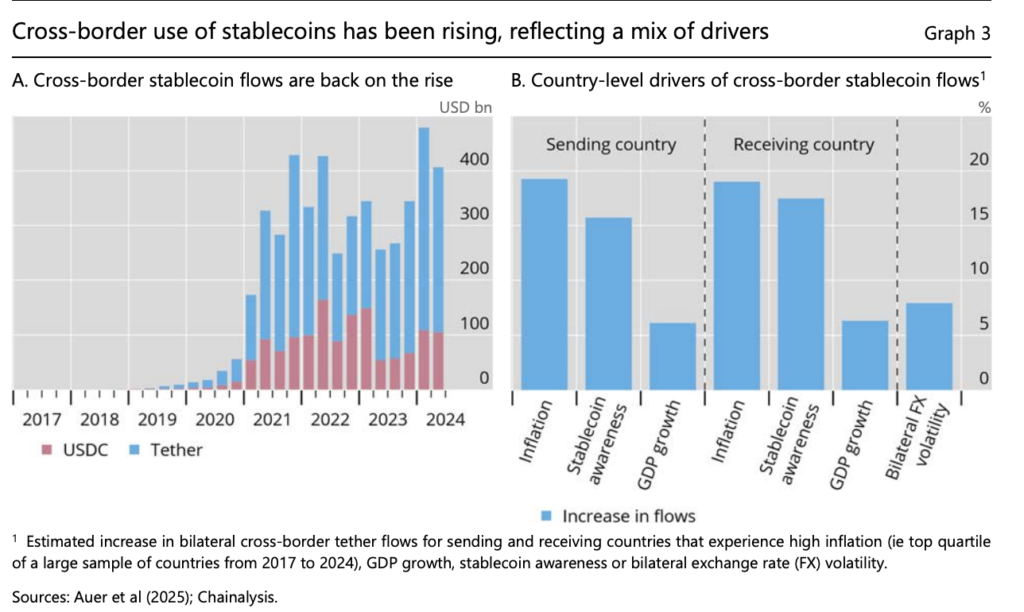

The BIS has consistently taken a hard stance against cryptocurrencies. In an April report, it claimed that digital assets could “destabilize the financial system” and even widen the global wealth gap. By June, the institution doubled down with a report titled “Stablecoin Growth: Policy Challenges and Approaches,” declaring that stablecoins fail as money and could create systemic risks.

At the same time, the BIS has been a loud advocate for central bank digital currencies (CBDCs)—a state-backed alternative to privately-issued crypto.

For crypto advocates like Perkins, this signals a coordinated effort to slow down decentralized networks while fast-tracking centralized digital currencies.

The Bigger Picture

Perkins’ remarks highlight a growing tension between traditional banking regulators and the crypto sector. While no outright bans are in place, the economic disincentives created by Basel’s capital rules could become one of the most effective “chokepoints” for the industry.

As governments and institutions push harder for CBDCs and regulated digital assets, the question remains: Will permissionless crypto survive in a world where holding it is made prohibitively expensive for the very banks that once powered global finance?

Crypto

16 Day Surge Spot Ether ETFs Add 453 Million in Inflows and Investors Say This Is Just the Beginning

Spot Ether ETFs continue their explosive streak with $453 million in inflows led by BlackRock as bullish momentum shows no signs of slowing

In an unprecedented run that has crypto bulls cheering, spot Ether ETFs have now notched their 16th consecutive day of net inflows, with Friday alone contributing a staggering $452.72 million, according to fresh data from SoSoValue. The bulk of that came from BlackRock’s iShares Ethereum Trust (ETHA), which alone pulled in $440.10 million, pushing its total assets under management to an industry-leading $10.69 billion.

The cumulative momentum of spot Ether ETFs has propelled total net assets across all U.S.-based funds to $20.66 billion, now representing 4.64% of Ethereum’s total market cap. With cumulative net inflows reaching $9.33 billion since their launch, Ether ETF adoption is clearly gathering pace—particularly among institutional investors betting big on Ethereum‘s long-term utility in DeFi, staking, and smart contracts.

With surging interest in stablecoins and tokenization, we expect strong ETH ETP inflows for a long time to come,” noted Matt Hougan, Chief Investment Officer at Bitwise, on X earlier this week.

BlackRock Dominates While Grayscale Lags

While BlackRock continues to dominate the leaderboard in the spot Ether ETF landscape, Bitwise’s ETHW trailed far behind with $9.95 million in inflows. Fidelity’s FETH also added a modest $7.30 million. On the flip side, Grayscale’s ETHE saw continued redemptions, logging a $23.49 million net outflow on the day, bringing its cumulative losses to a staggering $4.29 billion.

This divergence in performance among issuers is becoming increasingly pronounced, as investors flock toward more transparent and lower-fee funds offered by BlackRock and Fidelity, while older legacy products like Grayscale’s ETHE lose their shine.

Institutional Demand Outpacing Supply

What’s driving the surge in spot Ether ETFs? Experts say it’s a mix of improved regulatory clarity, Ethereum’s growing dominance in decentralized finance, and a belief that ETH will play a central role in future tokenized financial systems.

Matt Hougan estimates demand for Ether via ETFs and other exchange-traded products (ETPs) could reach $20 billion in the coming year, equivalent to 5.33 million ETH at current prices. That’s particularly significant when compared with Ethereum’s estimated issuance of just 0.8 million ETH in the same time frame — a mismatch that could lead to a supply squeeze.

We’re looking at a scenario where demand may outpace new ETH issuance by nearly 7X, said Hougan.

Spot Ether ETFs Outshine Bitcoin Counterparts

While spot Bitcoin ETFs also posted a rebound with $130.69 million in net inflows on Friday, they trailed Ether funds significantly. Bitcoin ETFs had seen three consecutive days of outflows earlier in the week totaling over $285 million, suggesting some rotation of investor interest toward Ethereum-based products.

Despite this, the cumulative total for spot Bitcoin ETF inflows remains higher, at $54.82 billion, with total net assets standing at $151.45 billion.

However, recent enthusiasm and performance metrics clearly favor spot Ether ETFs, especially as Ethereum’s broader use case continues to attract forward-thinking institutional players.

Will the 16-Day Streak Continue?

With daily inflows still going strong — including peak days like $726.74 million on July 16 — analysts are watching closely to see just how long this bullish streak in spot Ether ETFs can last. Since the streak began on July 2, total net inflows have more than doubled from $4.25 billion to over $9.33 billion.

And with Ethereum’s upcoming ecosystem upgrades, including developments around Layer 2 scaling, restaking, and more robust institutional-grade staking solutions, there’s reason to believe that investor appetite for spot Ether ETFs is far from satisfied.

Final Thoughts

This historic 16-day streak in spot Ether ETFs not only highlights a turning point in crypto investing but also shows how Ethereum’s evolving role in finance is driving real-world demand. While BlackRock leads the charge, the entire industry appears to be gaining ground in reshaping traditional portfolios.

If this trajectory holds, 2025 might just be the year Ethereum goes fully institutional.

Crypto

7 Big Wins as Ether ETFs Celebrate One Year with $16.6 Billion Milestone and Bullish Momentum

Ether ETFs close out their first year with strong inflows and over $16.6 billion in assets, fueling talk of staking and future crypto ETF innovations.

It’s been one year since Ether ETFs officially launched in the United States, and the celebration couldn’t have come at a better time. Marking their anniversary on July 23, the U.S.-based spot Ether ETFs have not only survived the rocky waters of the crypto market — they’ve thrived, now commanding over $16.6 billion in assets under management and locking in an impressive $8.69 billion in net inflows to date.

The U.S. Securities and Exchange Commission (SEC) gave the green light for spot Ether ETFs to trade in July 2024. Since then, major financial players like BlackRock, Fidelity, 21Shares, VanEck, Bitwise, Franklin Templeton, Invesco, and Grayscale have raced into the crypto ETF space with Ethereum-backed products.

And the market is clearly responding. Over the last 14 trading days alone, the funds saw nearly $3.9 billion in continuous inflows — a bullish streak that analysts say may just be the beginning.

“Nearly 1,000 ETFs have launched since these went live, and BlackRock’s Ether ETF leads all of them in inflows,” said Nate Geraci, president of NovaDius Wealth Management, on X. He added that six of the top seven best-ever daily inflows for Ether ETFs happened in just the past two weeks.

Ether ETFs gain serious momentum

The first anniversary was marked with a $332.2 million inflow on July 23 — the seventh-best day in the history of Ether ETFs. Just one week earlier, on July 16, the funds reached a record-breaking single-day inflow of $726.6 million.

That momentum has helped BlackRock’s iShares Ethereum Trust ETF (ETHA) pull in a massive $8.9 billion in net flows, making it the dominant force in the Ether ETF space. In contrast, Grayscale’s Ethereum Trust ETF (ETHE) has faced outflows of around $4.3 billion as its conversion from a trust to an ETF hasn’t been enough to keep investors on board.

“Investors are opting for newer ETFs with lower fees and better NAV tracking,” one analyst told Daily Global Diary. “BlackRock’s dominance just proves institutional confidence is shifting fast.”

Ether still lags behind Bitcoin ETFs

While Ether ETFs have had a stellar year, they’re still in the shadow of their older sibling: Bitcoin ETFs. Approved earlier in 2024, U.S. spot Bitcoin ETFs have raked in nearly $54.5 billion in net inflows, dwarfing Ethereum’s numbers.

Despite this, ETH is trading above $3,600, up 8% over the past 12 months, though still shy of its all-time high near $4,900 set in November 2021. The volatility hasn’t scared off long-term investors, many of whom see Ethereum’s upcoming roadmap — including staking and broader ecosystem growth — as reasons to stay bullish.

Staking could be the next big thing for Ether ETFs

What’s next for Ether ETFs? According to analysts, staking could be the major upgrade that propels the funds into a new growth phase.

The Ethereum blockchain offers rewards for those who lock up their assets to help secure the network — a process known as staking. Several ETF issuers are already pushing the SEC for permission to allow staking within their funds.

Approval could come as early as this month. If it does, it would likely spark another wave of inflows, giving investors access to yield-generating Ethereum exposure directly from regulated financial products.

In fact, the first ETF with staking was launched this month — a Solana-based fund issued by REX Shares and Osprey Funds. If Ethereum ETFs follow suit, it could be a game-changer for passive crypto investors.

-

US News1 week ago

US News1 week ago“She Never Made It Out…” Albany House Fire Claims Woman’s Life as Family Pleads for Help to Bring Her Home

-

Entertainment1 week ago

Entertainment1 week agoXG Star Cocona Shares a Brave Truth at 20 — “I Was Born Female, But That Label Never Represented Who I Truly Am…”

-

Tech1 week ago

Tech1 week agoAfter Losing Over $70 Billion, Mark Zuckerberg Finally Admits His Biggest Bet Is “Not Working” – Meta Plans Massive Cuts to Metaverse Budget

-

Entertainment1 week ago

Entertainment1 week agoSamba Schutte Reveals the Surprise Cameo in Pluribus That “Nobody Saw Coming”… and Why John Cena Was Perfect for the Role

-

Entertainment6 days ago

Entertainment6 days agoJudi Dench breaks silence on Harvey Weinstein and Kevin Spacey “I imagine he’s done his time…” — Hollywood stunned by her unexpected stand

-

Entertainment5 days ago

Entertainment5 days agoSaudi Arabia’s entertainment revolution… Red Sea Film Foundation CEO Faisal Baltyuor says he ‘wears many hats’ — but one mission drives them all

-

Entertainment1 week ago

Entertainment1 week agoMandy Moore Signs On for a Bold New Peacock Erotic Thriller — “A Twisted Game Where the Student Becomes the Teacher…”

-

Entertainment3 days ago

Entertainment3 days agoAmy Schumer and Chris Fischer Split After 7 Years of Marriage — Inside Their ‘Cohesive’ and Amicable Divorce