Business

Peacock’s Loss Widens to $552 Million Even as Subscribers Surge to 44 Million ‘Streaming Is a Long Game’

As Comcast posts its latest quarterly numbers, Peacock’s growing audience highlights the costly trade-off behind streaming expansion.

When subscriber numbers climb but losses deepen, the streaming business rarely offers simple answers. That tension was on full display this week as Peacock, the streaming platform owned by Comcast, reported a $552 million loss for the latest quarter—despite growing its subscriber base to 44 million users.

The figures were released as part of Comcast’s fourth-quarter earnings report, offering a clear snapshot of where the company’s streaming ambitions currently stand: expanding reach aggressively while absorbing heavy short-term financial pressure.

At first glance, the numbers look contradictory. How can a platform add millions of subscribers and still lose more than half a billion dollars in a single quarter? But for industry insiders, the answer is familiar—and expected.

Subscriber Growth Brings Momentum, Not Immediate Profits

Peacock has steadily increased its presence in an increasingly crowded streaming market dominated by Netflix, Disney+, and Amazon Prime Video. The service crossed the 44 million subscriber mark, fueled by exclusive sports coverage, popular NBCUniversal content, and aggressive bundling strategies.

ALSO READ : He Predicted Trump’s Kennedy Center Move… Then Bought the Domain: Meet the TV Writer Turning Power Into Punchlines

Much of that growth has been driven by live sports—particularly the NFL, Premier League, and Olympics-related content—along with recognizable franchises from NBCUniversal, including hit TV series and blockbuster films.

However, subscriber growth does not instantly translate into profitability. Content production costs, sports licensing fees, marketing expenses, and platform technology investments continue to weigh heavily on Peacock’s balance sheet.

Comcast Leadership Defends the Strategy

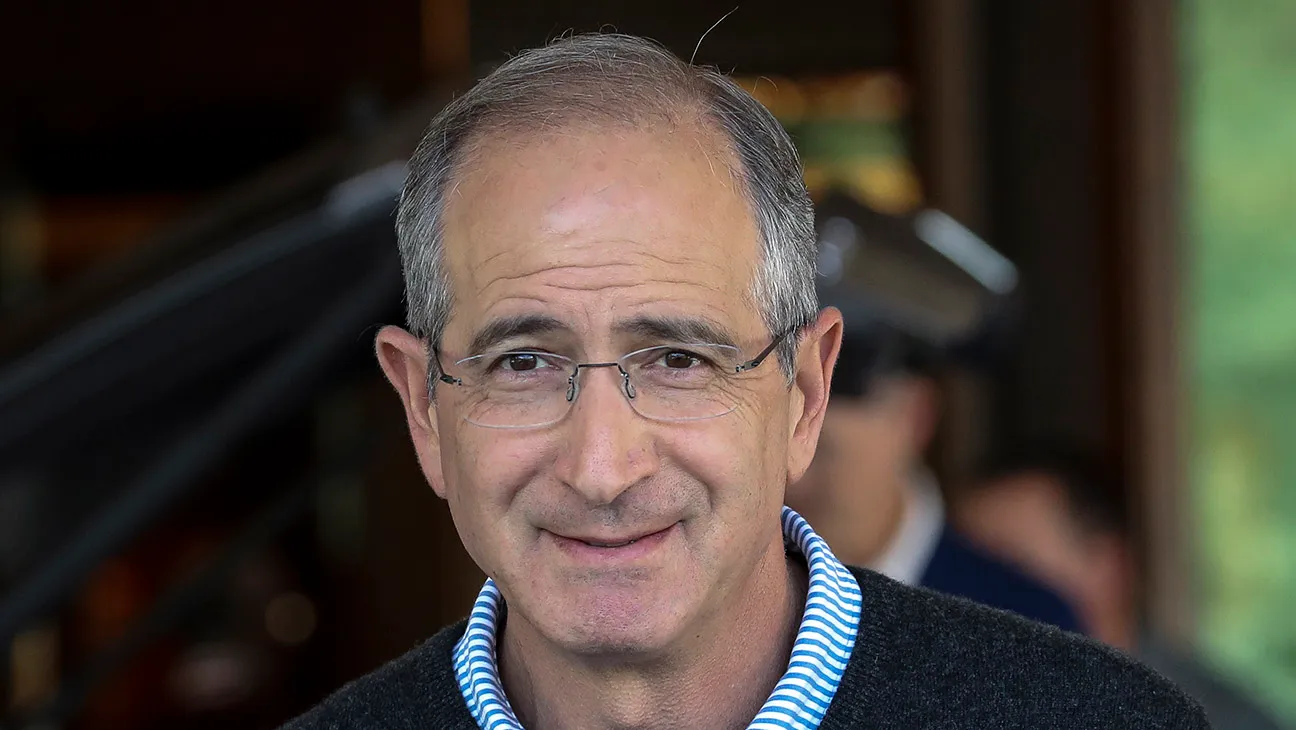

Despite the loss, Comcast’s top leadership struck a measured tone. Brian Roberts, Chairman and CEO of Comcast (Wikipedia), emphasized that streaming profitability is a long-term objective, not an overnight outcome.

Executives echoed that sentiment during the earnings call, framing Peacock as a strategic asset rather than a short-term profit center. Michael Cavanagh, Comcast’s President (Wikipedia), pointed out that subscriber engagement and brand relevance remain the company’s immediate priorities.

The message from the top was clear: growth first, profits later.

Why the Losses Are Still Growing

Peacock’s widening losses are tied to several structural realities of the streaming economy:

- Rising content costs, especially for exclusive sports rights

- Heavy marketing spend to attract and retain subscribers

- Continued technology and infrastructure investment

- Competitive pricing to prevent subscriber churn

Unlike traditional cable models, streaming platforms often operate at a loss for years before stabilizing. Industry analysts frequently cite Netflix’s early years, when the company burned cash aggressively to build global scale before turning profitable.

Streaming Wars Force Tough Choices

The broader context matters. The so-called “streaming wars” have entered a new phase, where growth is harder, customer acquisition costs are higher, and competition is intense.

While some platforms are scaling back spending, Comcast appears committed to keeping Peacock competitive—even if it means enduring near-term losses. That approach reflects a belief that long-term survival depends on owning a direct relationship with viewers rather than relying solely on legacy cable revenues.

Comcast’s Broader Financial Picture

Importantly, Peacock’s losses did not derail Comcast’s overall financial stability. The company continues to generate strong cash flow from its cable, broadband, and theme park businesses, giving it the flexibility to support Peacock’s expansion.

Analysts note that Comcast’s diversified revenue streams allow it to absorb streaming losses more comfortably than standalone streaming companies that lack legacy cash generators.

What Comes Next for Peacock

Looking ahead, Peacock’s path to sustainability likely depends on a combination of higher advertising revenue, pricing adjustments, and tighter content spending discipline. Executives have hinted that as the platform matures, cost controls will gradually improve margins.

For now, the focus remains on scale, relevance, and retention—three metrics Wall Street increasingly values alongside raw profit numbers.

As streaming economics continue to evolve, Peacock’s latest results underline a familiar truth in media: building the future is expensive, especially when the competition is global and relentless.

Business

What’s Still Open on Christmas Eve 2025? The Stores, Restaurants and Major Chains Americans Are Rushing To

From last-minute groceries to fast food fixes and gift shopping, here’s who’s open on December 24 — and who’s closing early

Christmas Eve has quietly become one of America’s busiest shopping and dining days. As millions prepare for December 25 celebrations, another holiday ritual unfolds — the last-minute dash for groceries, gifts, prescriptions, or a quick bite before stores shutter early.

In 2025, most major retailers, grocery chains, and restaurants are open on Christmas Eve, though many are operating on reduced or special hours. Planning ahead matters, especially as closing times vary widely by location.

Here’s a clear, category-by-category breakdown of what’s open on December 24, 2025, across the U.S.

Grocery Stores Open on Christmas Eve 2025

If you’re missing ingredients for dinner or dessert, these grocery chains are welcoming customers — but not all day.

- Aldi — Open, most locations closing around 4 p.m.

- Food Lion — Open until 7 p.m.; pharmacies from 9 a.m. to 3 p.m.

- Stop & Shop — Open until 6 p.m.

- Trader Joe’s — Open, closing at 5 p.m.

- Wegmans — Closing at 6 p.m.

- Whole Foods — Regular opening, closing at 7 p.m.

Tip: Many stores stop restocking shelves hours before closing — earlier visits are safer.

Drugstores Open on Christmas Eve

Pharmacies remain essential stops for holiday travelers and families.

- CVS Pharmacy — Open, though hours vary by location

- Walgreens — Open; pharmacy hours may differ from retail hours

Fast-Food Chains & Restaurants Open on Christmas Eve

Hungry during the holiday scramble? You have options.

- Applebee’s — Select locations open

- Chick‑fil‑A — Open Christmas Eve (closed Dec 25)

- Burger King — Open at most locations

- Dunkin’ — Open, hours vary

- IHOP — Open

- McDonald’s — Open, location-based hours

- Taco Bell — Open

- Starbucks — Many stores open, reduced hours

Domino’s stores are not required to open — customers should check local listings.

Mail, USPS, UPS: Are Deliveries Running?

Yes — with exceptions.

- United States Postal Service locations are open

- Mail delivery runs except Priority Mail Express

- Blue collection boxes will be picked up December 24

- UPS will deliver packages, though pickup schedules vary

Last-Minute Gift Shopping: Retailers Open on Christmas Eve

Most major retailers are open — but many close early.

- Best Buy — 8 a.m. to 7 p.m.

- Costco — Open

- Dollar General — Many open until 10 p.m.

- Home Depot — Closing at 5 p.m.

- HomeGoods, Marshalls, T.J. Maxx, Sierra — 7 a.m. to 6 p.m.

- IKEA — Closing early (varies by location)

- JCPenney — Opens 9 a.m., closing varies

- Kohl’s — 7 a.m. to 7 p.m.

- Macy’s — 8 a.m. to 7 p.m.

- Michaels — 7 a.m. to 6 p.m.

- Petco — Most close at 7 p.m.

- Target — 7 a.m. to 8 p.m.

- Walmart — 6 a.m. to 6 p.m.

Is the Stock Market Open on Christmas Eve?

Yes — but only for a short session.

U.S. stock markets are open on December 24, closing early at 1 p.m. ET, instead of the usual 4 p.m.

The Bottom Line

Christmas Eve 2025 remains one of the most active retail days of the year — but timing is everything. Many stores close earlier than usual, and some services scale back well before evening.

If you’re heading out on December 24, check local hours first, plan efficiently, and don’t wait until nightfall — the doors may already be locked.

For more Update- DAILY GLOBAL DIARY

Business

Netflix Chiefs Walk the Warner Bros. Lot… A Power Move After Paramount Skydance’s Bid Is Rejected

As Warner Bros. Discovery shuts the door on Paramount Skydance, David Zaslav rolls out the red carpet for Netflix’s Ted Sarandos and Greg Peters

In Hollywood, timing is rarely accidental — and neither are photo ops.

On the very same day that Warner Bros. Discovery’s board officially rejected Paramount Skydance’s hostile bid, WBD CEO David Zaslav made a conspicuously public statement about where his company’s future may be headed.

Zaslav welcomed Netflix co-CEOs Ted Sarandos and Greg Peters to the iconic Warner Bros. Studio lot in Burbank — a visit documented through a series of carefully released images that quickly caught the industry’s attention.

The message was subtle in tone but loud in implication.

A Walk Through Hollywood History

Photos released by WBD on Wednesday show Zaslav strolling alongside Sarandos and Peters across the legendary studio grounds, including a stop in front of the instantly recognizable Warner Bros. Water Tower — a symbol of nearly a century of film and television history.

Officially, the visit was described as a meeting between Netflix leadership and executives at the studio. Unofficially, it read as a public endorsement of Netflix’s vision — and perhaps, its wallet.

ALSO READ : Taylor Swift Quietly Changes Lyrics to Two Reputation Songs on Apple Music, Swifties Go Into Detective Mode

Just weeks earlier, on December 5, Netflix had its $82.7 billion bid for WBD’s streaming and studios division accepted. That division includes crown-jewel assets such as Warner Bros. Pictures, HBO, HBO Max, and DC Studios.

Why the Paramount Skydance Bid Fell Flat

Earlier that same day, WBD’s board formally rejected the hostile takeover attempt from Paramount Global and Skydance Media — a move that insiders say reflected both strategic concerns and cultural misalignment.

While Paramount Skydance’s offer aimed to consolidate legacy media power, Netflix’s proposal centers squarely on streaming dominance, global scale, and technology-driven growth — areas where the streamer has already proven its reach.

By opening the gates of the Warner Bros. lot to Netflix’s top brass, Zaslav appeared to signal not just preference, but confidence in where the deal is heading.

A Not-So-Quiet Signal to Hollywood

Hollywood executives are well aware that studio tours are rarely casual affairs. Allowing Sarandos and Peters to be photographed on the lot — especially amid active acquisition talks — sends a clear signal to investors, talent, and competitors alike.

It suggests continuity rather than disruption. Legacy rather than liquidation.

Netflix, long viewed as the industry disruptor, has increasingly positioned itself as a studio caretaker, not just a streaming platform. The Warner Bros. assets would give Netflix unprecedented access to intellectual property, prestige brands, and theatrical infrastructure.

For Zaslav, the optics matter. In an industry still grappling with streaming losses, debt pressure, and shifting audience habits, stability — or at least the appearance of it — can be as valuable as the deal itself.

What Happens Next

While regulatory approvals and shareholder reactions still loom, the visit underscores a reality that few in Hollywood now ignore: the battle for the future of legacy studios is being fought not behind closed doors, but in plain sight.

And sometimes, a walk past a water tower says more than a press release ever could.

Business

From DVSA to AI fleets… key leadership moves reshaping transport, automotive and tech sectors this week

New appointments at DVSA, Aion Auto, Microlise, Leasing Options, Motive, and GRS Fleet Graphics signal a busy end to 2025 for industry leadership

It has been a decisive week for leadership across the UK’s transport, automotive, logistics and AI technology sectors, with a series of high-profile appointments aimed at tackling long-standing challenges and preparing businesses for rapid growth in 2026.

From clearing driving test backlogs to launching new car brands and scaling AI-powered fleet platforms, these moves underline how talent and experience are becoming central to operational reform.

New DVSA chief tasked with tackling driving test backlog

The Driver and Vehicle Standards Agency (DVSA) has confirmed Beverley Warmington as its new Chief Executive, effective January 5, 2026. She takes over from Loveday Ryder, who has led the agency since 2021.

Warmington arrives at a critical moment, with learner drivers across the UK facing prolonged test waiting times that have affected employment and mobility. She brings nearly 20 years of public service experience, most recently as Area Director for London, Essex and Eastern England at the Department for Work and Pensions (DWP), where she oversaw operations involving more than 12,000 staff.

UK Roads and Buses Minister Simon Lightwood praised the appointment, saying Warmington has the operational leadership needed to “grip the driving test backlog” and ensure reforms translate into faster, safer access to driving tests.

Aion Auto strengthens UK launch plans with senior marketing hire

As Aion Auto gears up for its UK market entry in 2026, the brand has appointed Alex Key as Marketing Director, reporting directly to Managing Director Jon Wakefield.

Key brings more than two decades of automotive marketing experience, having previously held senior roles at Honda, BMW Group, MINI, and Suzuki GB. Her recent work included helping steer Suzuki through a major rebrand and its first electric vehicle launch.

Wakefield said her ability to shape brand identity will be “pivotal” as Aion prepares to introduce itself to UK consumers in an increasingly competitive EV market.

Microlise appoints new CTO to drive logistics innovation

Transport technology specialist Microlise has named Dean Garvey-North as its new Chief Technology Officer, succeeding Duncan McCreadie, who retires after a decade with the company.

Garvey-North brings senior digital leadership experience from the utilities sector and management consultancy. He is also a member of Gartner’s CIO community and a contributor to the Forbes CIO Technology Council.

Microlise CEO Nadeem Raza said the appointment reinforces the company’s ambition to remain the UK’s most trusted name in transport technology, particularly as logistics firms push for efficiency, sustainability and smarter data-driven operations.

Leasing Options promotes Danielle Jones to head of marketing

Manchester-based vehicle leasing firm Leasing Options has promoted Danielle Jones to Head of Marketing, recognising her role in a major transformation of the brand’s digital and customer strategy.

Since joining in 2024, Jones has led a rebrand, rolled out new TV and audio campaigns, and overhauled email marketing with redesigned customer journeys. In her expanded role, she will oversee all marketing, lead generation, social media and PR activity.

Chief Operating Officer Mike Thompson described the promotion as a “natural next step” aligned with the company’s long-term growth ambitions.

Motive adds AI heavyweight to board

AI-powered operations platform Motive has appointed Adeyemi Ajao to its Board of Directors, strengthening its leadership as it scales internationally.

Ajao is the co-founder and managing partner of Base10 Partners, a venture capital firm focused on technology transforming the real economy. Motive CEO Shoaib Makani said Ajao’s experience as a founder and investor will help translate AI innovation into durable enterprise value.

GRS Fleet Graphics appoints operating partner to support growth

GRS Fleet Graphics has appointed James Hopkins as Operating Partner, a move designed to strengthen operational capability across both GRS and Epic Media Group.

Hopkins brings extensive experience across automotive operations, fleet management, telematics and B2B services. General Manager Martin Tyrrell said his leadership will be key as the business continues to scale and serve mid-size and large fleets across public and private sectors.

A clear trend heading into 2026

Taken together, these appointments point to a wider trend: organisations across transport, automotive and logistics are investing heavily in experienced leadership to modernise services, deploy AI, and improve customer outcomes.

As 2026 approaches, these executives will be under close watch — not just for strategy, but for execution.

For more Update – DAILY GLOBAL DIARY

-

Entertainment1 week ago

Entertainment1 week ago“Comedy Needs Courage Again…”: Judd Apatow Opens Up on Mel Brooks, Talking to Rob Reiner, and Why Studio Laughs Have Vanished

-

Crime1 week ago

Crime1 week agoMan Accused in Tupac Shakur Killing Asks Judge to Exclude Critical Evidence

-

Entertainment1 week ago

Entertainment1 week agoOlivia Wilde and Cooper Hoffman Go Bold in I Want Your Sex—A Dark Comedy That Dares

-

Entertainment2 days ago

Entertainment2 days agoEnola Holmes 3 Gets Its First Look as Netflix Plans a Special Moment for Lewis Pullman Fans

-

Entertainment1 week ago

Entertainment1 week ago“She Did Bring It All on Herself…”: Sony Executives Break Silence on Blake Lively Fallout Around It Ends With Us

-

Entertainment1 week ago

Entertainment1 week agoCamilla Läckberg Says She Wants to ‘Conquer America’… Why Hollywood Is Her Next Big Target

-

Entertainment1 week ago

Entertainment1 week ago“I Want to Conquer America…”: Swedish Noir Icon Camilla Läckberg Reveals Her Hollywood Ambitions and Screen Dreams

-

Sports1 week ago

Sports1 week agoCaleb Williams Impresses, but the Bears’ Late-Game Decisions Raise Eyebrows